12 Months for Nationwide, 30 Days in Maine; Significant regulatory overhaul looming for American pet insurance

In Maine, a state senator and dog lover decided she had waited long enough for pet insurance legislation. When the National Association of Insurance Regulators (NAIC), the organization of state insurance officials, failed to pass a long-debated Pet Insurance Model Law in December, Maine Democrat Heather Sanborn pushed ahead on her own and put the model law to work in her own state.

Several days after Maine became the first state to sign the still-in-progress NAIC Pet Insurance model legislation into law, Sen. Sanborn told The Canine Review that she sponsored the bill “as a concept draft that basically was intended to get filled up with the NAIC model,” adding that she had been following the NAIC’s model and knew it had been scheduled for a vote at the end of 2021. Except, of course, that the legislation was suddenly pulled from the NAIC agenda in the waning hours of the group’s Winter Meeting without explanation.

Sen. Sanborn said experience as a dog owner with pet insurance motivated her to sponsor the legislation even though the NAIC ultimately did not adopt it. “We ended up not working on it at all in 2021 while we waited for the NAIC to complete their work,” Sen. Sanborn told TCR.

“I think it just seemed like the right time,” she said. “We decided we would go forward with the nearly-filed model from the NAIC, anticipating that it would actually get signed off on this spring,” Sen. Sanborn said. “I don’t know if that’s now not going to happen—but it doesn’t really matter.” In other words, in Maine at least, the waiting for the regulators finally to produce something is over.

Sidelined legislation doesn’t stop one state: “We decided we would go forward…”

Waiting Periods, Wellness Plans

Two topics dominated the discussions in Maine, Sen. Sanborn said: Waiting periods and marketing of wellness plans.

As we’ve explained – and as the many pet owners who been denied an insurance claim know — waiting periods stipulate that some specified maladies that show up during a stipulated period following enrollment in a plan will be considered a pre-existing condition exempt from coverage.

“I don’t know any of the ins and outs of the politics of the pet insurance industry,” Sen. Sanborn said, “other than that I didn’t think that this argument about consumer fraud really held water. So, I just rejected it and then dug in my heels,” she concluded, referring to industry claims that tough pre-existing claims clauses with long waiting periods are needed to give insurers protection against consumer fraud .

The waiting period debate was probably the most contentious at the national level in the NAIC’s Pet Insurance Working Group, which found itself engulfed in controversy. The Canine Review, having virtually attended all Pet Insurance Working Group meetings in the past two years, has detailed notes and transcripts of the work, in which representatives of the insurers repeatedly described the possibilities of consumer abuse or fraud.

“I don’t think we’re suggesting that everybody’s trying to cheat insurers, but I think there is unconscious, as well as conscious.” Dr. Jules Benson of Nationwide said during the discussions last July 2021. He added: “This dog limping, not seen by a vet, but they buy pet insurance. So, there’s no diagnosis at this point. But by day 115 or so, this has turned into a $5,000 surgery. So, again, we’re trying to make sure that we’re controlling consumer costs for everybody. I’m trying to make sure that insurers have the ability to – and again, not all insurers having these waiting periods, this is really not the industry asking me–to do that.”

30 Days In Maine

The current, albeit still-not-ratified version, of NAIC’s legislation limits waiting periods to 30 days. And that’s exactly what Sen. Sanborn’s Maine bill did. If the Model is finally adopted in the coming weeks and more state legislatures begin to put bills on agendas, the end of absurd waiting periods is one example of the kinds of significant changes we could start to see that would encourage more consumer confidence in an industry with so much abuse – and where consumer confidence is so low that the U.S. lags far behind other countries in the percentage of insured pets.

12 Months for Nationwide, Healthy Paws;

6 Months for Embrace, Lemonade, Petplan

Nationwide has a twelve-month orthopedic waiting period for cruciate ligaments or meniscus (knee) injuries . My own dog, Nellie injured her knee at about 8-10 months old leaping out of the back of an SUV. It’s astonishing that even if I had not moronically neglected to buy insurance for Nellie from the start, that if I’d bought her policy on Day 1 to avoid pre-existing conditions, that even if I’d taken those responsible steps that less than 3 percent of American pet owners take, several of the products available would still deny coverage of Nellie’s knee because the injury occurred inside the waiting period.

There’s also the fact that Nationwide Pet Insurance instructs its customer contact agents that they may not provide policy materials to a pet insurance shopper. Whatever the reason(s) may be, it would be less problematic if fine print were easier to locate on Nationwide’s website.

Pet Insurance Trade Association NAPHIA Reacts to Maine Moving Ahead

Asked if the pet insurance industry trade association, NAPHIA, had a reaction to Maine’s passage of the legislation, NAPHIA spokeswoman Kristen Lynch wrote.

NAPHIA is continuing to meet with state regulators as we anticipate the Model Law working its way to completion at the NAIC. Our strategies will be dependent upon this and will continue to be fluid while state regulators and legislators determine their own positions on the Pet Insurance Model Law and whether or how they will adopt it.

Our position has not changed throughout the NAIC process: We have continued to advocate for a Pet Insurance Model Law that is clear and can be consistently interpreted, leaves room for industry innovation and a range of product options to meet the needs of all pet owners, plus supports a product experience that is fair to both new and existing policyholders. Our advocacy in Maine was consistent with this.

Meantime, Pet Insurers Face New Data Reporting Requirements

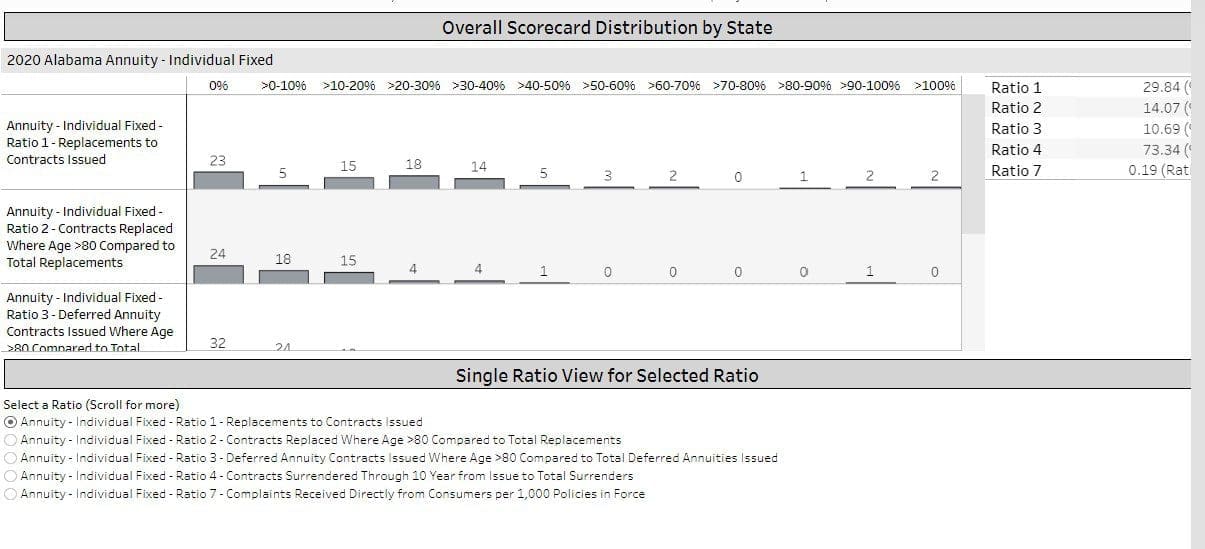

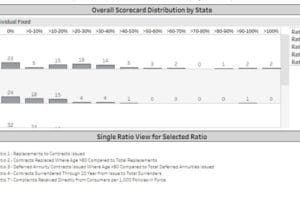

As we reported in December, although debates over waiting periods and wellness marketing linger, the most significant regulatory changes looming for pet insurers most likely will involve the work Matthew Gendron of Rhode Island has been doing in. Gendron, who is a member of the Pet Insurance Working Group at the NAIC, is among the regulators particularly focused on data reporting requirements as an active member of the Market Analysis Procedures (D) Working Group, part of the Market Regulation and Consumer Affairs (D) Committee.

Because pet insurance is currently a sub-category within a sub-category, the industry does not have the same reporting requirements as it would if Pet Insurance was, instead, a single category.

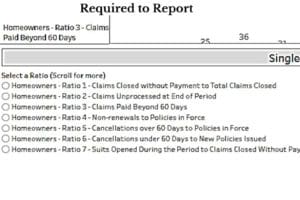

Now Gendron is working to get regulators to require pet insurers to file data such as:

Ratio 1: Claims closed without payment to total claims closed.

Ratio 2: Claims unprocessed at end of period.

Ratio 3: Claims paid beyond 60 days.

Mr. Gendron is also likely to lead the charge or be among those leading the charge to require pet insurers to report an exhaustive list of data points such as premium data, number of cancellations within 60 days, number of lawsuits, and number of complaints. These are all examples of data that pet insurance companies would need to report in a standardized, consistent way that would be public.

But here’s the catch: The identity of the company behind each data point would not be provided to the public. Rather, the identification of the company behind the data is only made available to regulators for purposes of conducting oversight.

However, in the event that a company attracts regulatory scrutiny and eventually is cited, at that point, everything would become public, Gendron explained. So, shoppers should be able to see all of this before buying a policy (as should those of us who report on the industry in order to inform shoppers!). But as of now, even Gendron and his fellow regulators are unable to see inside the pet insurance products the way they can monitor and gain access to information about other lines of insurance.

And then there’s the ultimate data point: loss ratios. That’s the percent of every dollar you pay in premiums and others pay to an insurer that is actually paid back out to you in claims.

Wouldn’t you like to know if your insurer pays, say, 90% of its premiums back you its customers in claims versus 60%?

One more note: It’s not just the ultimate result that makes the next stage of regulatory work significant (which may be a lucky thing, given that a result has been so illusory). The drafting process and with it the policy debates shine a bright light on the companies that are asking you to buy their products. And we’ll continue to shine that light. If Company X wishes to take a position (or if it does not), this is moment of truth for consumers to learn about the people behind the fine print who ultimately define the promises behind their brands.

Next Tuesday, June 7, the Pet Insurance Working Group, a subcommittee task force established by the Property and Casualty (C) Committee, part of the country’s largest insurance regulatory body, the NAIC (National Association of Insurance Commissioners), will convene for the first time in about six months.

The delay was unexpected and came suddenly in the hours leading up to when it was thought that the bill would be going up for a full vote to adopt the legislation in a meeting of insurance regulators last December.

Now, the legislation is back to the drawing board and the Pet Insurance Working Group will meet once again. There’s no reason to assume the Working Group will adopt the proposed changes, especially given the strong opposition from one of two consumer representatives, Birny Birnbaum. Birnbaum’s opposition, expressed by email to TCR last week, pertains to Section 7’s proposed changes in the current draft which have mostly now been crossed out.

Next Tuesday, June 7, the Pet Insurance Working Group, a subcommittee task force established by the Property and Casualty (C) Committee, part of the country’s largest insurance regulatory body, the NAIC (National Association of Insurance Commissioners), will convene for the first time in about six months.

The delay was unexpected and came suddenly in the hours leading up to when it was thought that the bill would be going up for a full vote to adopt the legislation in a meeting of insurance regulators last December.

Now, the legislation is back to the drawing board and the Pet Insurance Working Group will meet onc again. There’s no reason to assume the Working Group will adopt the proposed changes, especially given the strong opposition from one of two consumer representatives, Birny Birnbaum. Birnbaum’s opposition, expressed by email to TCR last week, pertains to Section 7’s proposed changes in the current draft which have mostly now been crossed out.

which pertains to requirements for people who sell insurance, or producer (insurance administration) licensing requirements for people who sell insurance or receive any kind of commission from providing advice about insurance.

The draft would, once again, need to be adopted by the full C Committee and, finally, put to a full vote. The regulators’ next National Meeting will be August 9-13, 2022 in Portland, Oregon. This is the earliest point at which the Pet Insurance Model Law could be formally adopted.

The next presumed item on the regulatory agenda for pet insurance at the NAIC is financial data reporting requirements that would aide regulators in overseeing pet insurer conduct. Matthew Gendron of Rhode Island, who is a member of the Pet Insurance Working Group at the NAIC, is among the reulators