Can Vet-Centric Trupanion Continue to Deliver? High-Flying Insurance Maverick Hits Headwinds

Last month, vet-centric pet insurer Trupanion told shareholders they could expect as much as a twenty percent drop in member retention in 2023 because of premium rate hikes that the company “fully anticipated.” The executives at Seattle-based Trupanion reported fourth quarter earnings in mid-February:

“We were hearing noises in the market around vet inflation picking up and, and more frequent rate increases than typical,” Trupanion President Margi Tooth told analysts in Manhattan the day following earnings at a conference when asked to discuss the rate hikes.

So, you’re retaining fewer pets: you’re raising prices on people—and they’re stopping the coverage?” Bank of America securities analyst Joshua Shanker asked Ms. Tooth.

So, you’re retaining fewer pets: you’re raising prices on people—and they’re stopping the coverage?” Bank of America securities analyst Joshua Shanker asked Ms. Tooth.

“Is that correct?”

“Uh, that’s a little extreme,” she replied.

“You’re trying to get headlines here. Nice try.”

Ms. Tooth has been with Trupanion for ten years, rising through the ranks quickly. She moved her family from the UK to Seattle for the job. According to the press office, she is now overseeing day-to-day operations as Trupanion CEO and founder Darryl Rawlings begins to step back from his more than twenty years at the helm.

Both executives declined our requests for comment following the February 15, 2023 earnings call.

“We consider the impact on our [member] retention,” Ms. Tooth continued. So, with our rate changes, we’ve moved more members into a 20% plus bucket. We know when people are in the 20% rate change bucket, there is a slightly lower retention rate. So, we fully anticipate it.”

In other words, yes, Mr. Shanker’s analysis was correct. Premiums are going up, and member retention rates are going down.

“By the end of this year, we will have gone through an 18 percent increase across our book of business,” Ms. Tooth explained, adding, “it takes about twelve months for that to flow through…From a margin perspective, our target is to be at fifteen percent adjusted operating margin and we will be at fifteen by the end of the year.”

Turbulence, “Headwinds”

One month ago, just before the company reported its earnings, the financial blog Seeking Alpha posted a brutal report highlighting “headwinds” for Trupanion. Citing “margin pressure” the analyst noted that “the pet insurance sold by TRUP is not cheap, and could be an expense that households drop (or don’t purchase) as the economy weakens.”

I’m a satisfied Trupanion policy holder — my dog is a fanatic–who believes that veterinarians should be raising their prices significantly, a point of view I know I share with Trupanion’s leaders. And to help clients pay for those services, no other carrier can pay veterinary hospitals in real time in North America–not the way Trupanion does. And no other pet insurer owns its underwriter. So, the stability and security Trupanion affords customers is notable in a not-so-reliable industry.

Mr. Rawlings, Ms. Tooth, and their entire team deserve credit for what they’ve done and what they continue to do for pet owners and veterinary professionals. Trupanion provides the most practical solution, with its proprietary software that gets around the reimbursement model, thereby distinguishing itself as the only pet insurer that can pay the veterinary hospital in real time as the pet owner is checking out–and isn’t this the purpose of insurance? What good is pet insurance that takes weeks, days, or even hours to process your claims?

So, I’m not as pessimistic as Seeking Alpha.

But the challenges ahead are undeniable.

5-Year Plan Halfway Point

The company isn’t just facing premium hikes that come with today’s inflationary environment. The company is now approaching a halfway point of its sweeping 5-year plan for expansion issued by founder/CEO Rawlings in his 2020 shareholder letter (our story about that plan here). Here’s an excerpt from the plan Rawlings outlined:

In totality, our 60-month plan describes how we intend to increase the value proposition for our members while dramatically increasing our service levels over the next five years. It describes how we plan to add distribution channels, and expand on our partnerships with State Farm and Aflac, and access the 1 million puppies and kittens that are visiting the veterinarian for the first time every year. Our 60-month plan details how we plan to expand our insurance product lines to include PHI Direct and Furkin (our low and medium ARPU products, respectively), expand our geographies by entering Japan and Europe, as well as add a new monthly subscription pet food where we hope to verify our hypothesis that pets eating a healthy diet in the right amount of calories will be healthier. In addition to all of the above, we outline how we are going to organize our existing “Trupanion” subscription business into distinct regions, how we will continue to drive high rates of growth in the breeder channel; and how we are continuing to harness the benefits of social media and other direct-to-consumer marketing channels. If we achieve the goals in our 60-month plan, we’ll grow revenue to over $1.5 billion, reach over 3.5 million pets and deliver growth in intrinsic value of over 25% per year.”

How is that ambitious 60-month plan progressing? It’s a question we’ve been unable to get clarity on over the past several months, although Rawlings normally provides more information in his annual shareholder letter which is due out in early April.

Nonetheless, those lower-priced insurance products, PHI-Direct and Furkin, still have not launched in the United States, although Mr. Rawlings and Ms. Tooth forecasted that both would be rolling out in the U.S. “before the end of the year” when the 60-month plan was unveiled in the spring of 2021. Now, almost two years later, although PHI Direct and Furkin have both been underway in Canada since July 2021, Ms. Tooth and Mr. Rawlings have gone radio silent on how the products are faring. Neither Ms. Tooth nor Mr. Rawlings responded to detailed questions for comment about PHI Direct and Furkin, declining multiple requests for comment through spokesman Michael Nank. (Our unanswered inquiries begin August 10, 2022 and have continued since then.)

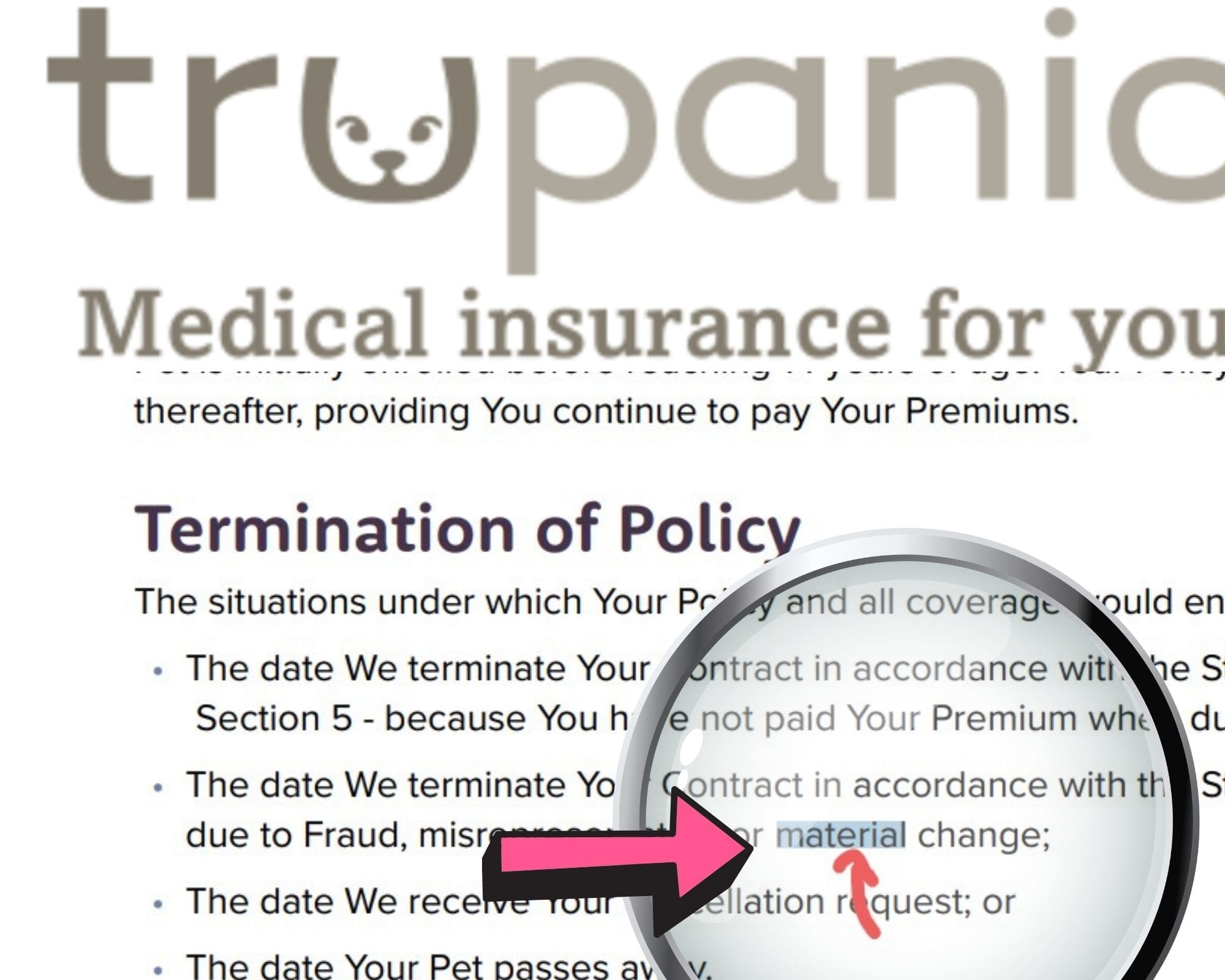

One thing we do know is that Furkin has the distinction of being Trupanion’s first subscription product with a “material change” emergency escape hatch cancel clause. To put it simply, a “material change” emergency escape hatch cancel clause is the way insurance companies insure themselves. And, until TCR discovered this language in the Furkin policy last spring, we could assert, accurately, that Trupanion was the only carrier in the market that was not using this language. In fact, we used Trupanion’s abstinence to query its competitors, pressing them to explain the reason for the language in their materials if Trupanion did not have the language in its materials. To put it plainly, this clause says the insurer reserves the right to cancel the policy when there is a “material change” — meaning, when the covered cost becomes more expensive. In the case of pet insurance, “material change” would be the result of a pet’s sickness or injury. The fact that Trupanion’s core subscription products both in the United States and in Canada are the only products in North America without the language is worth highlighting.

Yet, Mr. Rawlings and Ms. Tooth declined to comment when asked if the cancel clause language would be included in any policies in the United States.

“Shitty Language”

When asked about the Canada boilerplate pictured above in April of 2021, Mr. Rawlings denounced the “shitty language” in a live, on record interview and maintained that the language was in the process of being removed. Nearly one year later and after repeated emails seeking clarity, the language is still there. Mr. Rawling’s has declined through his spokesman to explain its continued presence or say whether the language would be entering the U.S. policies.

Trupanion Mum On Food Project

As for Landspath, the company’s food project, the last time Trupanion talked to TCR about it with any substance was in 2021–for this story we published that October. It seems like a century ago: As the Landspath story was being completed, Trupanion spokesman Michael Nank noted that he was sure I’d spoken to more people for the Landspath story than he’d met in the company, the point being how accessible and transparent the company was at the time. There were no ground rules and no person was off limits. To Trupanion’s credit, the company was fully transparent at the time.

The reticence now may also have something to do with the fact that Mr. Rawlings is aware of another topic TCR has been covering closely: diet-associated dilated cardiomyopathy or DCM. Landspath is a joint venture with Rayne, whose logo is a legume, the largely implicated ingredient in the fatal heart condition in dogs. More on this to come.

Much of the content on the Landspath website we discussed in our earlier story has since been erased, another matter the company has not explained except to tell us that they’ve been closely following TCR’s reporting on DCM.

Growing Pains

Trupanion has a phenomenal product — in fact, it’s the best in its market. But at a time when the company is enduring the challenges that ultimately come with ambition and a high maverick profile amid fast growth, its leaders are going to have to learn to deal with more scrutiny from a more sophisticated press that becomes more skeptical the bigger and more important the target becomes.

Related:

Trupanion announces sweeping 60-month plan, change to mission statement, Furkin

Trupanion launches lower-cost, “Furkin awesome” Furkin [“fur-child”]