Trupanion stock plunge persists, CEO stays mum, loss ratios rise

Trupanion’s stock price continued to decline late Tuesday afternoon. It’s been a rough eighteen months for the Seattle-based pet insurer, whose stock price has been on a downward trend since early 2022, now dipping below $20 to new 52-week low. We’re trying to match the timeline of the stock fall-off with events affecting the company and the industry to understand if and how Trupanion’s prospects have declined as much as its market cap.

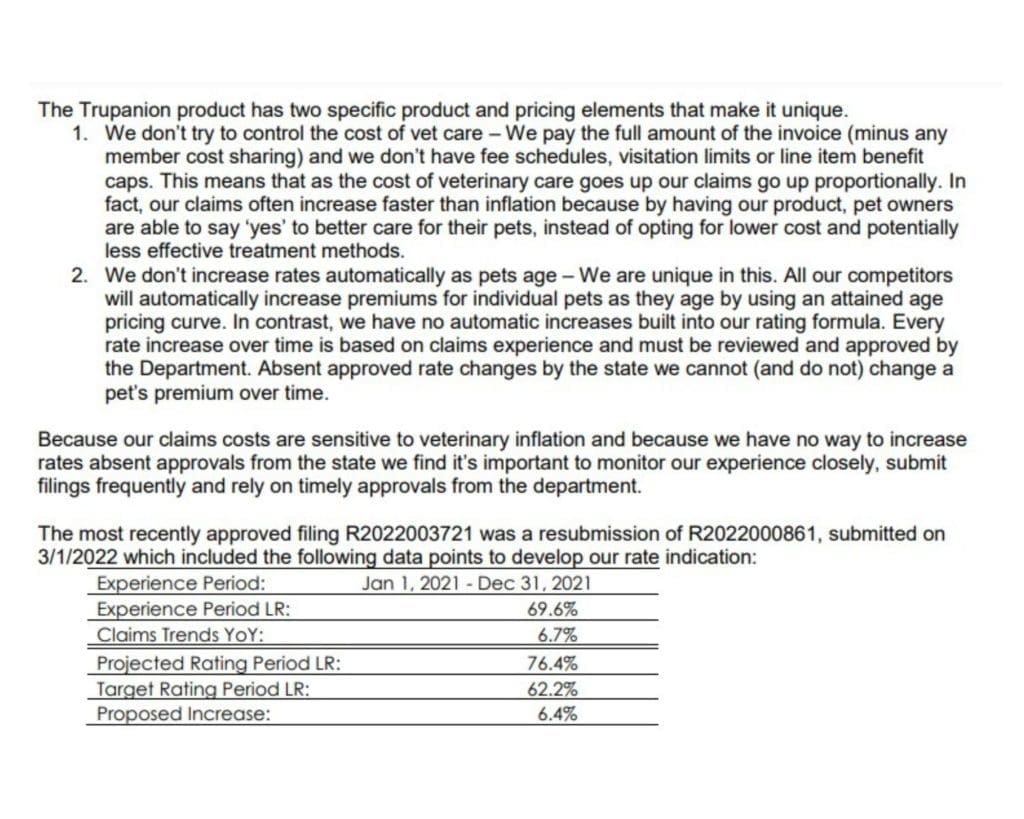

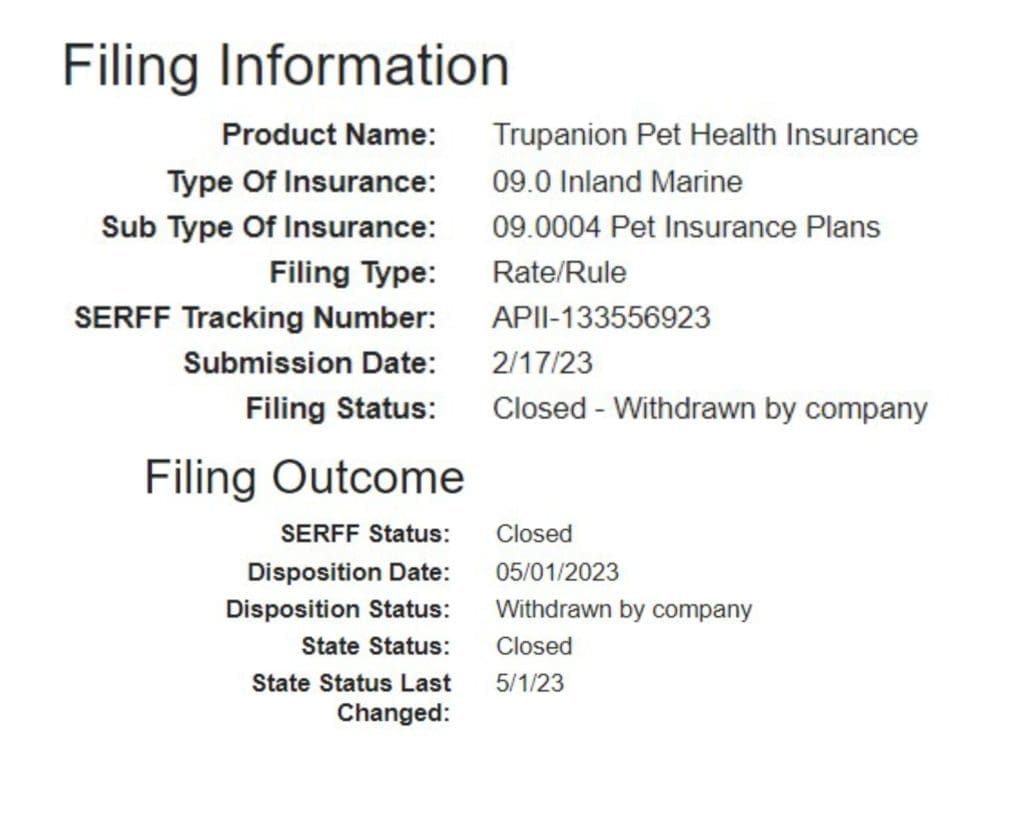

For two weeks, TCR has been seeking comment from Trupanion founder and CEO Darryl Rawlings and, in recent days, Trupanion’s Board of Directors, about a change in the company’s value proposition, or at least what would appear to be a change based on recent statutory filings with the departments of insurance in both California and in New York (see below). The filings show that Trupanion indicated a target loss ratio of 62.2. This is the ratio of payouts an insurer makes for medical expenses incurred by its members compared to the dollars it receives from them in premiums. This is the kind of rich target loss ratio enjoyed by his rivals that Mr. Rawlings used to deride, and he took great pleasure in explaining why, on the record: “I would prefer that the target [loss ratio] of each product be stated on the front page of everybody’s [filing] and on their website at the point where [customers] enroll,” Rawlings told TCR in an interview in August 2021. “I would love that.

“The chances of that happening are really low because every single insurance company would shit their pants,” Rawlings added.

That was August 2021, which now seems like a century ago.

Last Friday afternoon, the only response we could obtain from Trupanion was through spokesman Michael Nank, who, earlier last week, had also informed TCR that although the Annual Shareholders’ meeting would still be open to the press – we asked because the company’s once transparent, press friendly posture had already changed so dramatically over the past several months – that there would be no opportunity at any point during the course of the day for reporters to ask questions.

In short, TCR was provided with a less candid response to detailed requests for comment from Trupanion. Instead of an exchange with Mr. Rawlings, who once engaged high-impact policy debates, press questions were now dealt with in the same ineffectual, bureaucratic way Mr. Rawlings said Trupanion was founded to disrupt.

Company spokesman Michael Nank told TCR he was unable explain why the target loss ratio was 62.2. He would only refer us to the most recent SEC filing, in which he says the target loss ratio is 72.

Other questions that remain to be answered are consequential, not only for Trupanion, but for veterinary medicine and for the pet insurance market in North America. So, TCR reached out to Trupanion’s Board of Directors – each person individually – for input. We also contacted several managers, advisors, former employees, and industry stakeholders.

We’ve had several helpful responses, but we’re still hoping more of you will contribute to our reporting. . Please be in touch

We’re trying to match the timeline of the stock fall-off with events affecting the company and the industry to understand if and how Trupanion’s prospects have declined as much as its market cap.

More to come.

Related:

Trupanion’s Deal With The Chewy “Devil”: Veterinary Medicine’s Savior Or Insurance Industry Sellout?