Pet insurance carrier attempt to slash coverage for vet professionals goes mostly unacknowledged as vet trade group stays mum

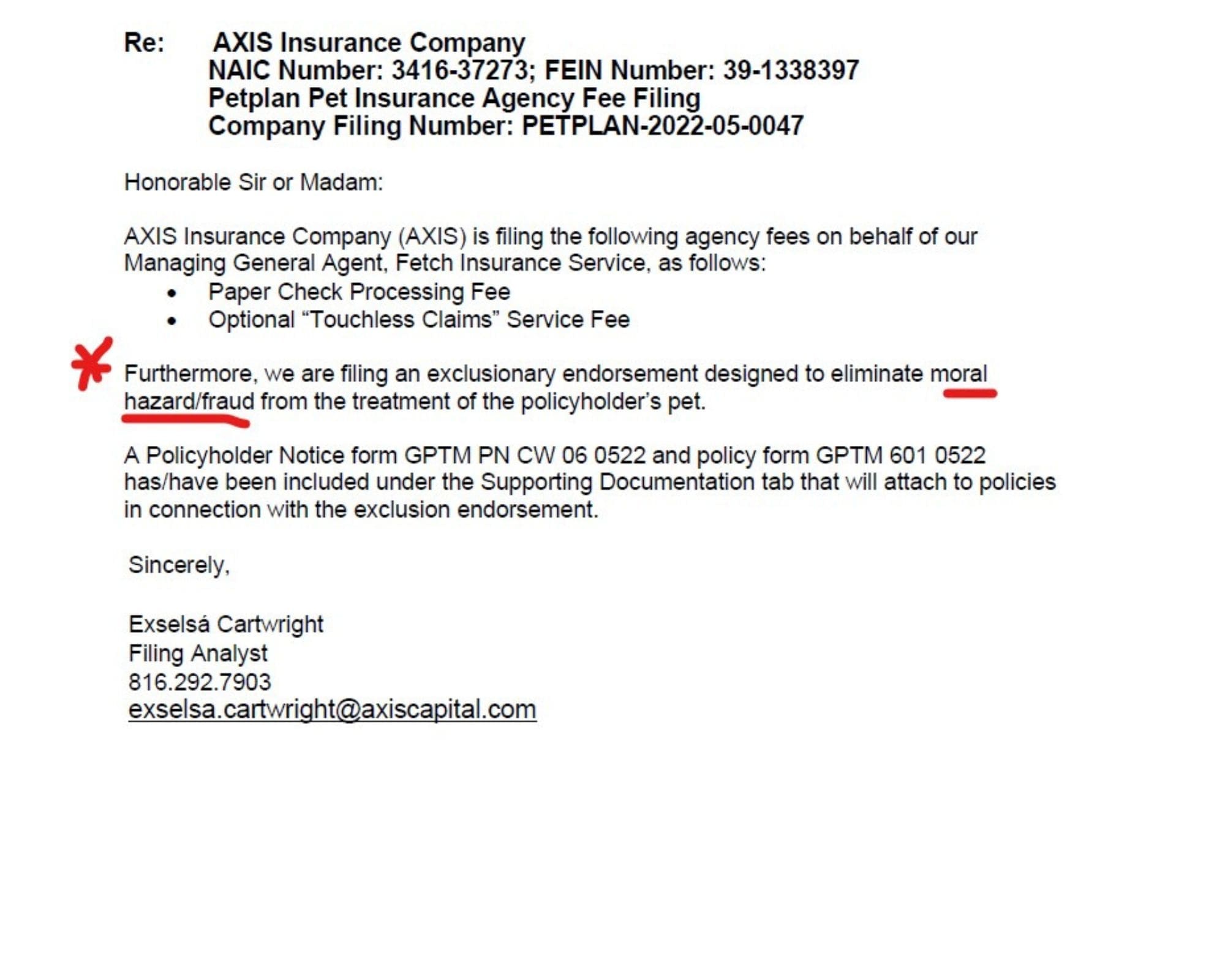

Last month, The Canine Review reported exclusively on a leading pet insurance carrier’s filing documents which declared veterinary professionals seeking coverage when the provider is an employer or even “business associate” to be a “moral hazard/fraud.” The insurance company, Fetch by The Dodo also known as Petplan, was seeking regulatory approvals for policy exclusions that had the potential to turn the pet insurance industry’s most authoritative, impactful referral channel – the nation’s veterinary professionals – into an enemy. Not surprisingly, TCR’s reporting on The Dodo’s “moral hazard” gaffe and attempt to slash veterinary professionals’ coverage prompted a social media firestorm.

Even more ven more astonishing than the explosive reaction, though, was the non-reaction from the people supposedly charged with representing veterinarians.

The rest of the pet insurance industry sat on the sidelines, too, ignoring the attack by a competitor on a major industry stakeholder.

TAKEAWAYS

- TCR pressed Lemonade, Nationwide, Pet’s Best, Embrace, Healthy Paws, AKC Pet Insurance, ASPCA Pet Insurance, Spot, Pumpkin, Metlife, as well as the pet insurance industry’s trade group, NAPHIA. All were asked multiple times to comment on singling out vet professionals for exclusion as well as on the merits of “moral hazard” language.

- Only Trupanion would take a position–and, only Trupanion would say that it would not implement such exclusions in the future.

- No AVMA official would take a position despite repeated requests to leaders, even when asked to comment on the merits of the “moral hazard/fraud” language.

- The media elites behind the insurance company continue to refuse to comment, among them former PETA board member who founded The Dodo, Isabel Lerer.

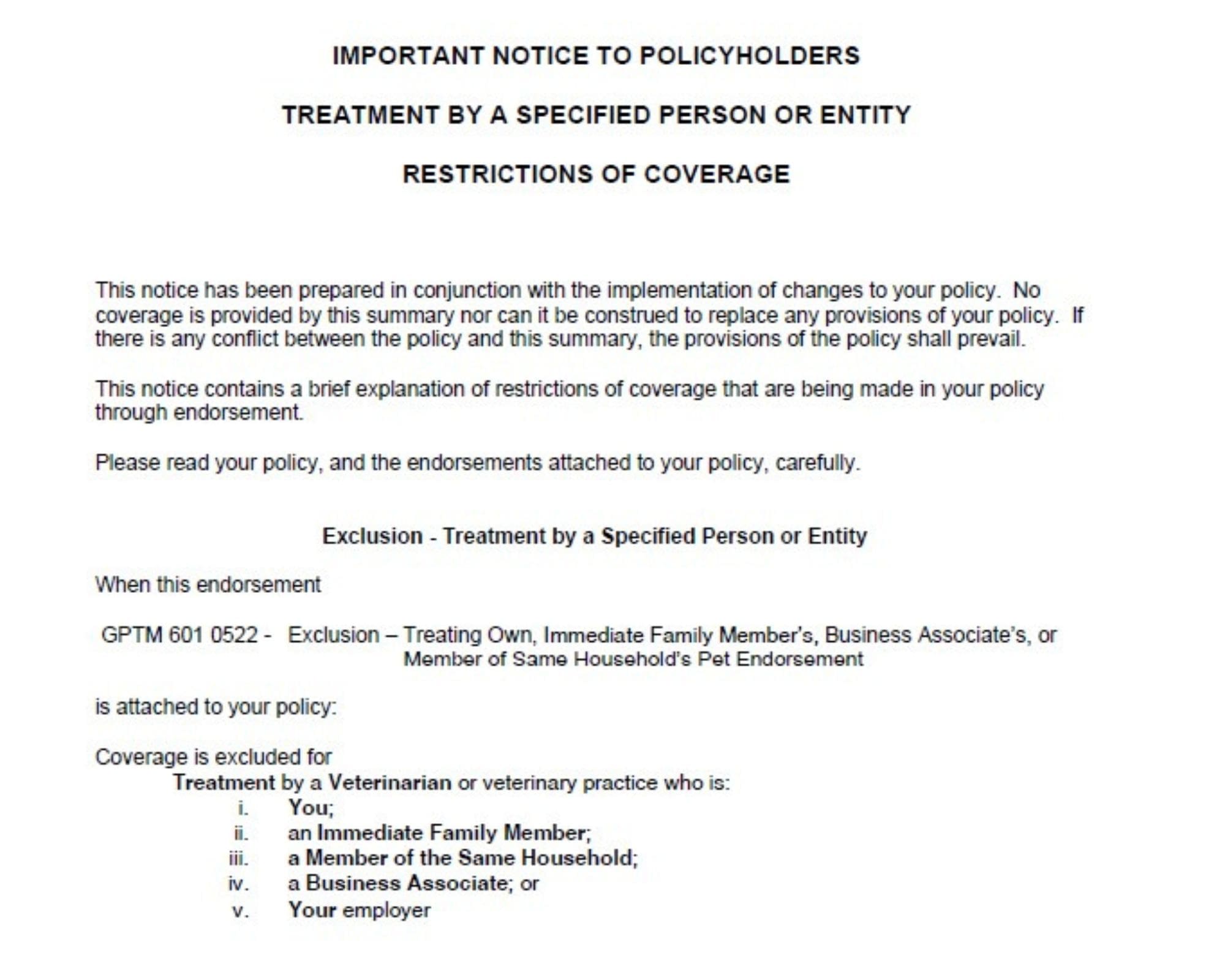

Fetch by the Dodo’s filing documents, which TCR uncovered during the course of routine monitoring, declared that pet insurance policyholders would not be eligible for covered claims when treatment was provided by a veterinarian or veterinary practice that is also one’s employer or business associate. That meant that anyone working for a veterinary practice or for any entity ‘associated’ with one could not have claims covered by that provider. Such claims, The Dodo declared, constituted a “moral hazard/fraud.”

For a host of reasons — among them convenience and, with a staffing shortage impacting veterinary hospitals around the country, availability, too, one’s “employer” may also be the only hospital in town — veterinary professionals normally seek care within their own hospitals. Moreover, discounted care is also a standard employee benefit.

By the time TCR’s second story was out less than a week later, the veterinary profession’s social media universe was on fire. Days later, Petplan, which had recently rebranded under the auspices of an elite New York media brand, capitulated.

The fact that Fetch by the Dodo/Petplan issued an anonymous statement via social media vowing not to move forward with the policy exclusion is a victory for veterinary professionals.

However, the silence from other carriers seems all the more concerning as does the silence from the organization that’s supposed to represent the profession’s interests, the AVMA.

Why Would Petplan Slash Coverage For Veterinary Professionals?

According to Margi Tooth, the president of Trupanion – the one insurance company to go on the record opposing PetPlan’s move — actuary data shows that veterinary professionals tend to adopt “what we consider ‘lemons’ as their companions,” explained Tooth. “What this inevitably means,” she added, “is that their pets have a higher rate of utilization that the average pet owner. There’s no conspiracy here – it’s a profession that can’t face putting a pet to sleep that could be saved – so when an owner walks in with a sick pet that they can’t afford to treat, they’re often adopted by the team in the hospital. These folks are heroes on many levels.”

Social Media Reaction To Fetch By The Dodo's "Moral Hazard" Insult

Pet Insurance versus Vets

After Petplan/Fetch by The Dodo issued its anonymous statement vowing to withdraw the exclusions, veterinary professionals continued to seek clarity from individual carriers. TCR has been seeking comment from individual carriers as well as the North American Pet Health Insurance Association (NAPHIA) for more than three weeks.

“It’s a huge deal because as far as I know, this is the first insurance exclusion targeting a very specific group of people. It opens up all kinds of doors,” says veterinary technician Kelsey Carpenter.

What is NAPHIA’s position on targeting veterinary professionals for coverage exclusion who are arguably the industry’s most essential advocates?

Rick Faucher, who is the executive director of NAPHIA’s board, would only say that NAPHIA does not comment on the activities of individual companies, declining repeated requests to take a position on targeting veterinary professionals or even on the merits of moral hazard language.

NAPHIA’s reticence may also be well founded. After all, many carriers already have policy language along the same lines, though not as expansive or vague as what Petplan was attempting (“business associates” and “employer”).

IAIC, which underwrites Figo and AKC Pet Insurance among others, has language excluding veterinarians from treating their own pets or those of their immediate family.

Healthy Paws’s policy states, “Veterinarian shall not include a member of your immediate family.”

U.S. Fire/Crum and Forster, which underwrites ASPCA Pet Insurance, Spot, and Pumpkin, among others, excludes “treatment when the veterinarian conducting, or supervising is you or a co-owner on your account.” Chairman and CEO Marc Adee did not return emails seeking clarification nor did he respond when asked if Crum & Forster could commit not to implementing the same exclusions in the future.

Embrace’s policy says the examining veterinarian “for the purposes of medical information or for an Orthopedic examination cannot be you or related to you.”

When asked for his reaction to the fact that even the AVMA refused to take a position on the “moral hazard” language in addition to the other insurance carriers, Paul Diaz, a former U.S. Marine who founded Hire Power Consulting, and advises veterinary professionals said:

“If they’re not planning to do the same thing that Petplan is doing, why wouldn’t they comment?” he said of the insurance carriers. “It just tells me that this is that hypocrisy that exists in the veterinary industry that nobody will call out. Everybody wants to be, ‘Oh, we love veterinarians. We want to do everything for them. As long as it doesn’t touch our margins.”

The U.S. pet insurance industry has reported consistent double-digit growth, rivaling any industry including e-commerce. But the percentage of American households that buy pet insurance has held stubbornly below the 2.5% mark, dwarfed by the rates of pets insured in the United Kingdom (around 25%), even as inflation climbs, and the cost of veterinary care has never been higher.

However, the American experience with human health care and health insurance is unique for its cost and for the degree to which its consumers are dissatisfied with the way health insurers charge and deliver on claims.

So, what’s the challenge the American pet insurance industry clearly faces? It’s that human healthcare system and the distrust of those who insure its consumers has obviously made American distrustful of health insurance generally.

But there could be one antidote: A pet owner’s most trusted authority when it comes to his or her pet are veterinary professionals. If insurers can get this community on their side, this advocacy could radically improve that embarassing rate of insured pets (again, less than 3 percent).

That’s why Petplan’ s conduct is so astonishing. Even more astonishing, though, is the refusal of the pet insurance industry’s trade group to take a position.

How We Uncovered The Dodo’s “Petplan” Plan

Our primary source in the stories about The Dodo/Petplan, in fact, is Petplan—or, Fetch By The Dodo — the company’s own documents. Pet insurance is regulated at the state level. Any time pet insurance companies wish to make changes to existing policies or add new products, they’re required to seek permission from state regulators by submitting rate and form filings to those states where they wish to make changes. TCR uncovered the Petplan filings during routine monitoring of state departments of insurance filings by pet insurance companies.

Where do we get these documents? Here, we must credit the Center for Economic Justice’s Birny Birnbaum, who helped this reporter learn the ins and outs of something called “SERFF” or the System for Electronic Rate and Forms Filing.[1]

The filing declared that insurance claimants could not file claims for care provided by their employers, meaning that anyone working for a veterinarian could not have claims covered by that provider. Such claims, Petplan’s Fetch By The Dodo, declared, constituted a “moral hazard.”

To this reporter, who has observed the dynamics of the symbiotic relationship between pet health care providers and those who insure pet owners so that they can pay these providers, PetPlan’s filing was evidence that the company was clueless about the need not to alienate these providers, as was the non-reaction by all but one of the company’s fellow-insurers.

Veterinary Professionals Cry Foul, AVMA Winces

But so, too, was the reaction – or, actually, non-reaction – of the American Veterinary Medical Association, the main trade group for American veterinarians that is supposed to represent the interests of veterinarians and presumably should understand how directly pet health insurance products impact the veterinary profession and that vet-friendly insurers represent a potential easing the profession’s staffing shortage by facilitating the price hikes veterinary hospitals badly need to implement.

The trade association’s reaction certainly doesn’t match the fiery response we saw from its members. The reaction to our reporting by the veterinary community has been unlike any other response TCR has prompted in our almost three years since launching.

“This is so awful” says Renee Mack of New Hampshire, who says she works as an adoption coordinator. “Why on Earth would a veterinarian take their pet to ANOTHER PRACTICE for care? We are all colleagues whether we work in the same practice or not. This response is ridiculous.”

“We need to follow up and make sure they withdraw it,” practice owner of The Palliative Vet, Lynn Hendrix, commented in a thread on Facebook.”

“We met with Fetch The Dodo last week to express our concern”

The American Veterinary Medical Association (AVMA) represents close to 100,000 veterinarians–all of whom who may want to rethink their membership dues.

After spending nearly the entire month of July seeking comment from AVMA’s Dr. Janet Donlin, Dr. Douglas Kratt, Dr. Lori Teller, Dr. Gail Golab, and Isham Jones, no leader would speak for the story or even comment. A spokeswoman, Lisa Howard, would only say the following in an email:

“We met with Fetch The Dodo last week to express our concern about the referenced exclusion language in pet insurance policies.” Ms. Howard added: “They told us they are withdrawing their associated filings in all states and that their proposed policy exclusion was never implemented.” However, Howard declined multiple requests to provide any names of individual who attended the meeting representing either party and Petplan/Fetch by The Dodo CEO Paul Guyardo did not return email or text messages to his personal phone seeking comment on the meeting or whether he was ever aware of such a meeting.

[1] “This new interface,” its homepage explains, “provides consumers and other interested parties the ability to access Rate and Form Filings via the Internet that the participating state has marked available.”

The Dodo Caves - Saturday, July 30

After listening to those who reached out to us, we recognize that this exclusion had consequences on the veterinary community that we never intended. For that reason, we will not enforce the exclusion submitted to state regulators and will immediately begin the process to withdraw it completely.

After listening to those who reached out to us, we recognize that this exclusion had consequences on the veterinary community that we never intended. For that reason, we will not enforce the exclusion submitted to state regulators and will immediately begin the process to withdraw it completely.

Quite simply, there will be no changes whatsoever to your coverage, reimbursement or the manner in which you treat your pets.

In the coming weeks, we will also be introducing a veterinary advisory board that we’ll consult with before making any future changes to our insurance product and policy terms. This board will also ensure that we’re constantly listening and supporting your work.

We sincerely value our longstanding relationship with the community and recognize the invaluable role that vets, and vet techs play in maintaining the health and wellness of the pets we all love.

Thank you for bringing this matter to our attention

Other Insurers, Except One, Stay Silent

After three weeks of repeated requests seeking comment from other pet insurance executives and press officers – in addition to the pet insurance industry’s main trade group, the North American Pet Health Insurance Association (NAPHIA) – no pet insurance company would take a position on the matter of targeting veterinary professionals for exclusion, or even on the merits of “moral hazard” language with respect to veterinary professionals.

The sole exception is Trupanion, whose president, Margi Tooth, has been outspoken and readily available for comment.

Dr. Carrie Jurney is a board certified veterinary neurologist and practice owner living in the San Francisco Bay Area. Dr. Jurney is also a founding board member and president of Not One More Vet (NOMV), a 501 c(3) nonprofit whose mission is to prevent veterinary suicide and promote mental health and wellness in the veterinary profession. “We work with them pretty extensively at NOMV because their product is run by veterinarians,” Dr. Jurney said when asked what she made of Trupanion speaking out. “They are very veterinarian and veterinary professional focused and they’ve got good hearts over there. That’s who I insure my pets with. Because they behave that way.”

We trust the veterinary profession, which is why we would never contemplate putting that type of exclusion in our coverage,” Trupanion president Margi Tooth told TCR last week.

We trust the veterinary profession, which is why we would never contemplate putting that type of exclusion in our coverage,” Trupanion president Margi Tooth told TCR last week.

Most notably, Trupanion opened its second quarter earnings conference call on August 3, just days after The Dodo issued its apology statement, with a not-so-subtle nod to the company’s “trusted partnership with the veterinary profession.” Founder and CEO Darryl Rawlings noted, “What I’m most excited about is that after years of shouting from the rooftops that veterinarians should be raising their prices faster, we are finally starting to see it in our data.” Ms. Tooth followed Rawlings:

There are times when something happens in the world that exacerbates the problem that we at Trupanion are trying to solve when we face an even greater duty to step in and make a difference. Today’s inflationary environment with mounting economic uncertainty and increasing pressure on our veterinary partners is one of those times. We partner with veterinarians to ensure that pet parents are able to provide for their pets unexpected care. Today, those trusted stewards for veterinary teams are struggling more than ever before, burdened with the rising cost of care, overworked, tired and stressed. Veterinarians have been pushed to the point of burnout. Couple this with a backdrop of rising inflation and the fact that today the majority of pet owners cannot afford more than $1,400 in unexpected veterinary costs.”

‘What is it about a veterinarian that leads to moral hazard? Or fraud?

It’s not sensible,” Center for Economic Justice’s Birnbaum said in an interview, reacting to the Petplan filings. “What is it about a veterinarian that leads to moral hazard? Or fraud? Are you saying they make stuff up? “Or” Birnbaum continued, “Are you saying that since they’re more familiar with the language, we should exclude them because they’re likely to actually make a legitimate claim that we don’t want to pay?”

The Dodo Implodes

It was not until last Saturday afternoon that Petplan lan moved to extinguish the Internet and social media firestorm ignited by its statutory filings.

Late that day, Petplan issued the following statement to the veterinary profession vowing to withdraw the policy:

After listening to those who reached out to us, we recognize that this exclusion had consequences on the veterinary community that we never intended. For that reason, we will not enforce the exclusion submitted to state regulators and will immediately begin the process to withdraw it completely.

Quite simply, there will be no changes whatsoever to your coverage, reimbursement or the manner in which you treat your pets.

In the coming weeks, we will also be introducing a veterinary advisory board that we’ll consult with before making any future changes to our insurance product and policy terms. This board will also ensure that we’re constantly listening and supporting your work.

We sincerely value our longstanding relationship with the community and recognize the invaluable role that vets, and vet techs play in maintaining the health and wellness of the pets we all love.

Thank you for bringing this matter to our attention

The Larger Context

So, here’s the story so far. A leading pet insurer offends veterinary professionals by getting caught trying to implement new policy language that would slash their coverage, explaining the exclusion by stating that they present a “moral hazard.”

And, after getting caught, the insurance company issues a statement saying they’re sorry, they’re forming a veterinary advisory board, and they’re immediately going to begin withdrawing the added language.

Tomorrow will be Saturday, August 13: two weeks since the insurance company capitulated. No documents have been withdrawn on the System for Electronic Rates and Forms Filing (SERFF), which is where TCR uncovered the documents at the center of this story. And all but one insurance company, Trupanion, declined to take a position on the merits of “moral hazard” language or go on record as committed never to implementing an exclusion like Petplan’s. The pet insurance industry’s trade association, NAPHIA, too, refuses to take a position. Even the veterinarians’ trade group, the AVMA, tries to remain on the sidelines.

It makes for a startling lack of self-awareness, and self-interest, by both trade groups. At a time when the U.S. lags the rest of the developed world in pet insurance coverage because pet owners don’t trust insurance companies, it would seem obvious that the veterinary community could be the insurers’ best sales people. Conversely, at a time when the veterinary industry is facing twin crises of morale and necessity to raise prices, thereby making the need for pet insurance more urgent than ever, it seems just as obvious that the vets need the insurers. Yet when one clueless insurer clumsily infuriates the veterinary community, the trade associations on both sides stay silent.