Dodo partner Petplan calls veterinary professionals “moral hazard”

Irony Alert! Fetch By The Dodo/Petplan’s “Moral Hazard” Gaffe

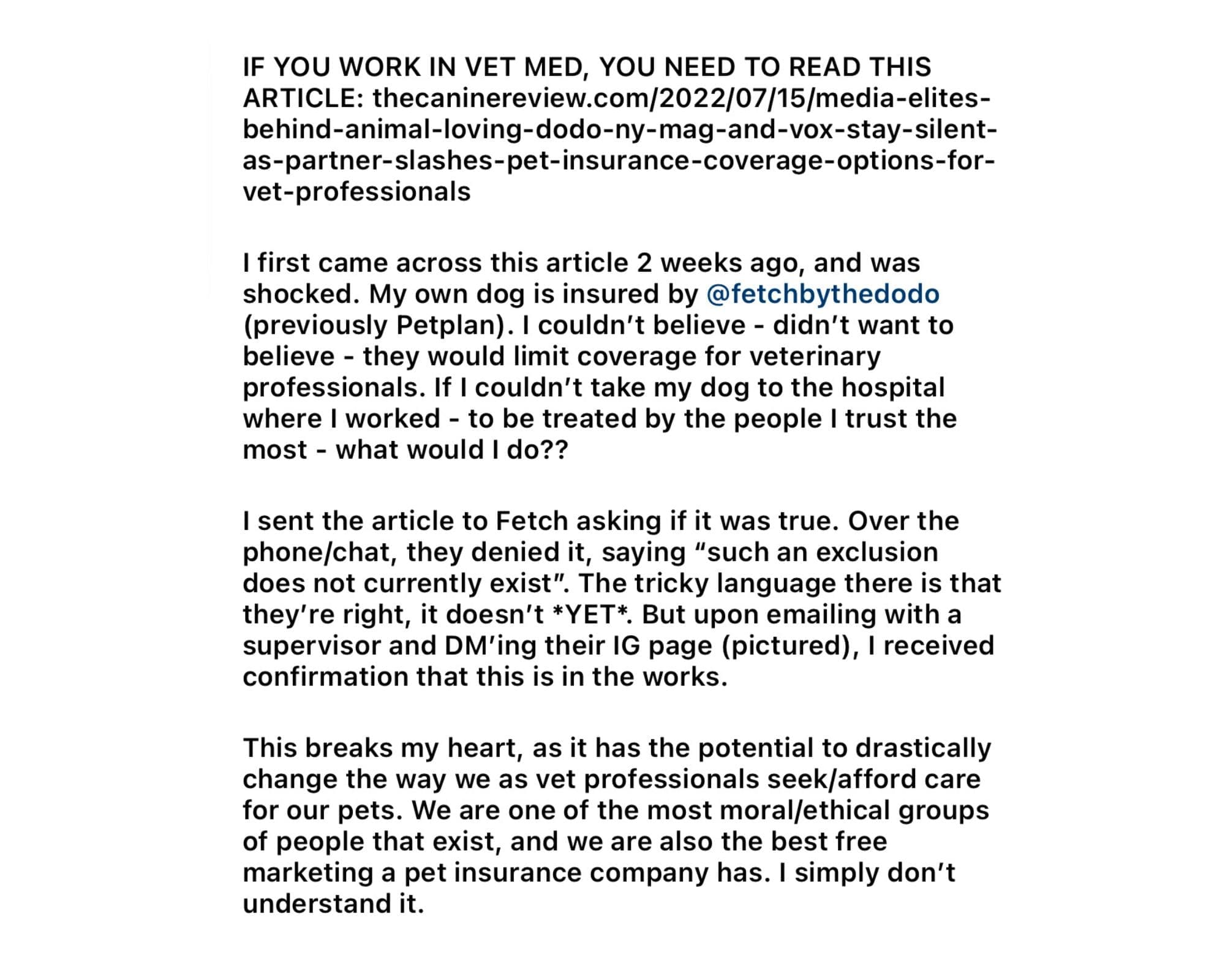

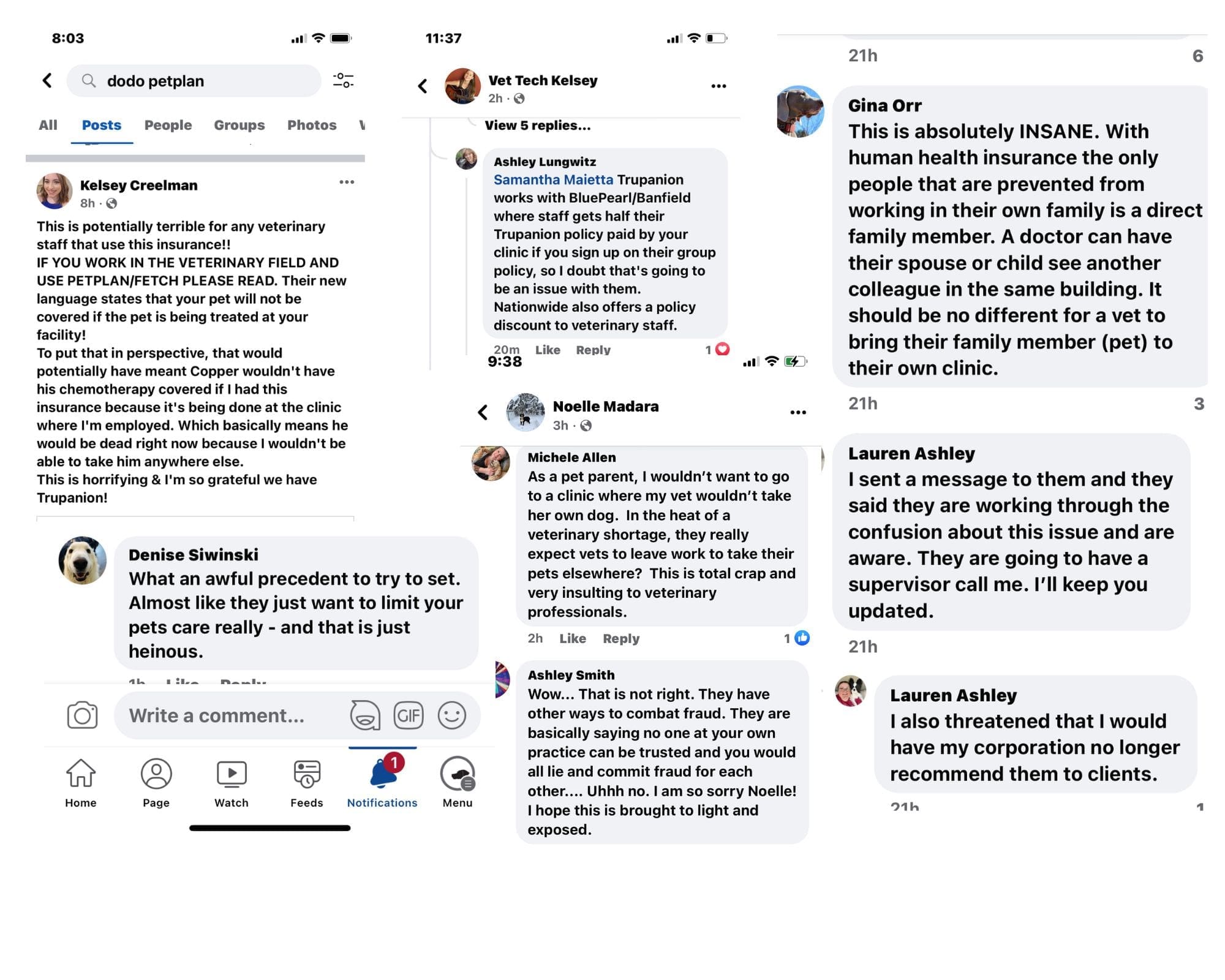

The insurance company, Fetch by The Dodo also known as Petplan, is seeking regulatory approvals for policy exclusions which have the potential to turn the pet insurance industry’s most authoritative, impactful referral channel – the nation’s veterinary professionals – into an enemy of a viral video blog about animals whose founder was involved with People for Ethical Treatment of Animals (PETA). Not surprisingly, TCR’s reporting on The Dodo’s “moral hazard” gaffe and attempt to slash veterinary professionals’ coverage has prompted a social media firestorm.

Last Friday, we reported that pet health insurer Petplan — now rebranded as “Fetch by the Dodo” to reflect its new partnership with The Dodo, the animal-loving viral video blog – had started rolling out an exclusion in its policy that slashes coverage options for veterinary professionals.

A leading pet insurance carrier’s filing documents – the forms an insurance carrier must file with each state department of insurance when a change in policy or rate is requested – declared veterinary professionals seeking coverage when the provider is an employer or even “business associate” to be a “moral hazard/fraud.”

Why Would Petplan Slash Coverage For Veterinary Professionals?

According to Margi Tooth, the president of Trupanion – the one insurance company to go on the record opposing PetPlan’s move — actuary data shows that veterinary professionals tend to adopt “what we consider ‘lemons’ as their companions,” explained Tooth. “What this inevitably means,” she added, “is that their pets have a higher rate of utilization that the average pet owner. There’s no conspiracy here – it’s a profession that can’t face putting a pet to sleep that could be saved – so when an owner walks in with a sick pet that they can’t afford to treat, they’re often adopted by the team in the hospital. These folks are heroes on many levels.”

“We are filing an exclusionary endorsement designed to eliminate moral hazard/fraud from the treatment of the policyholder’s pet,” the filing said, referring to veterinary professionals.”

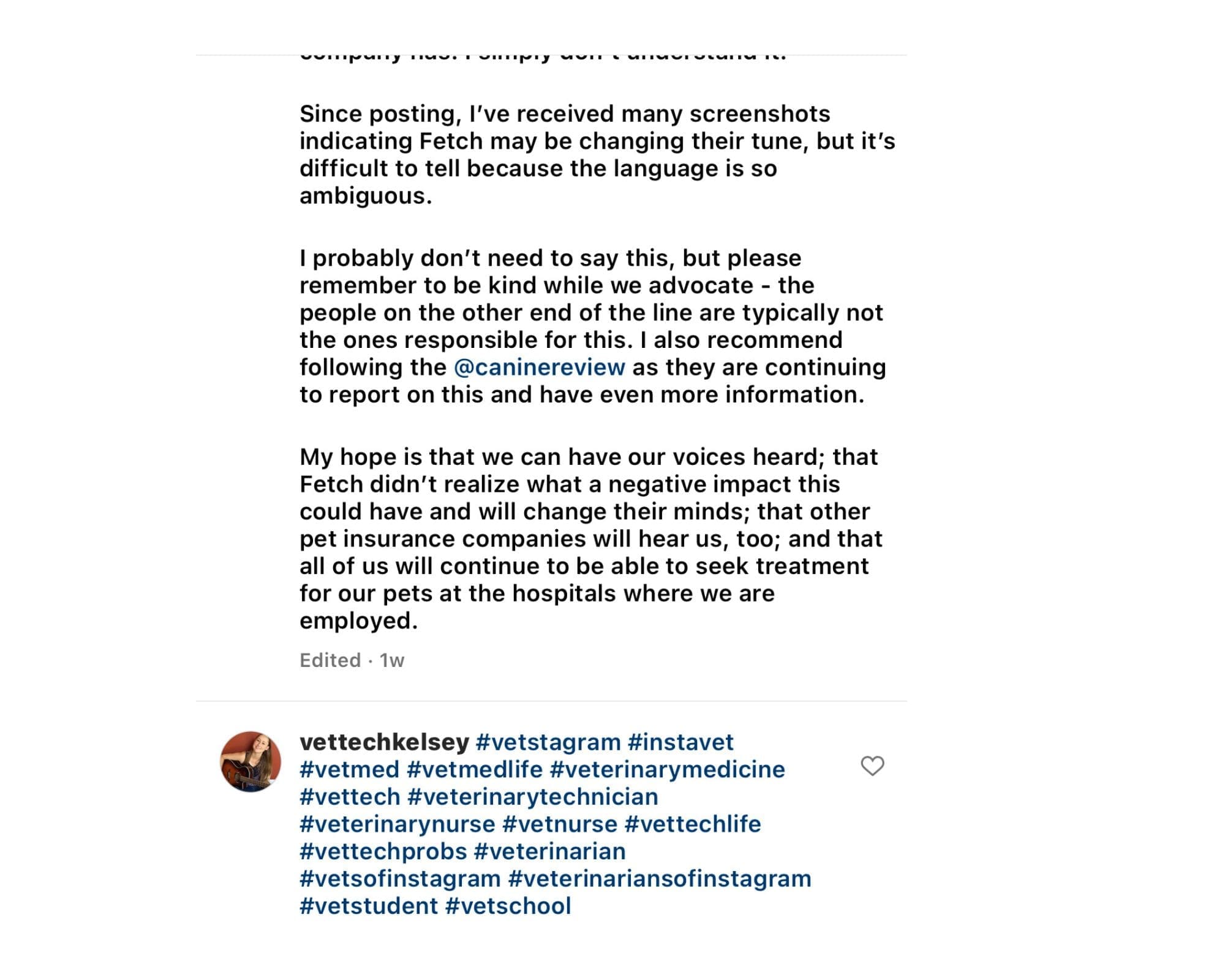

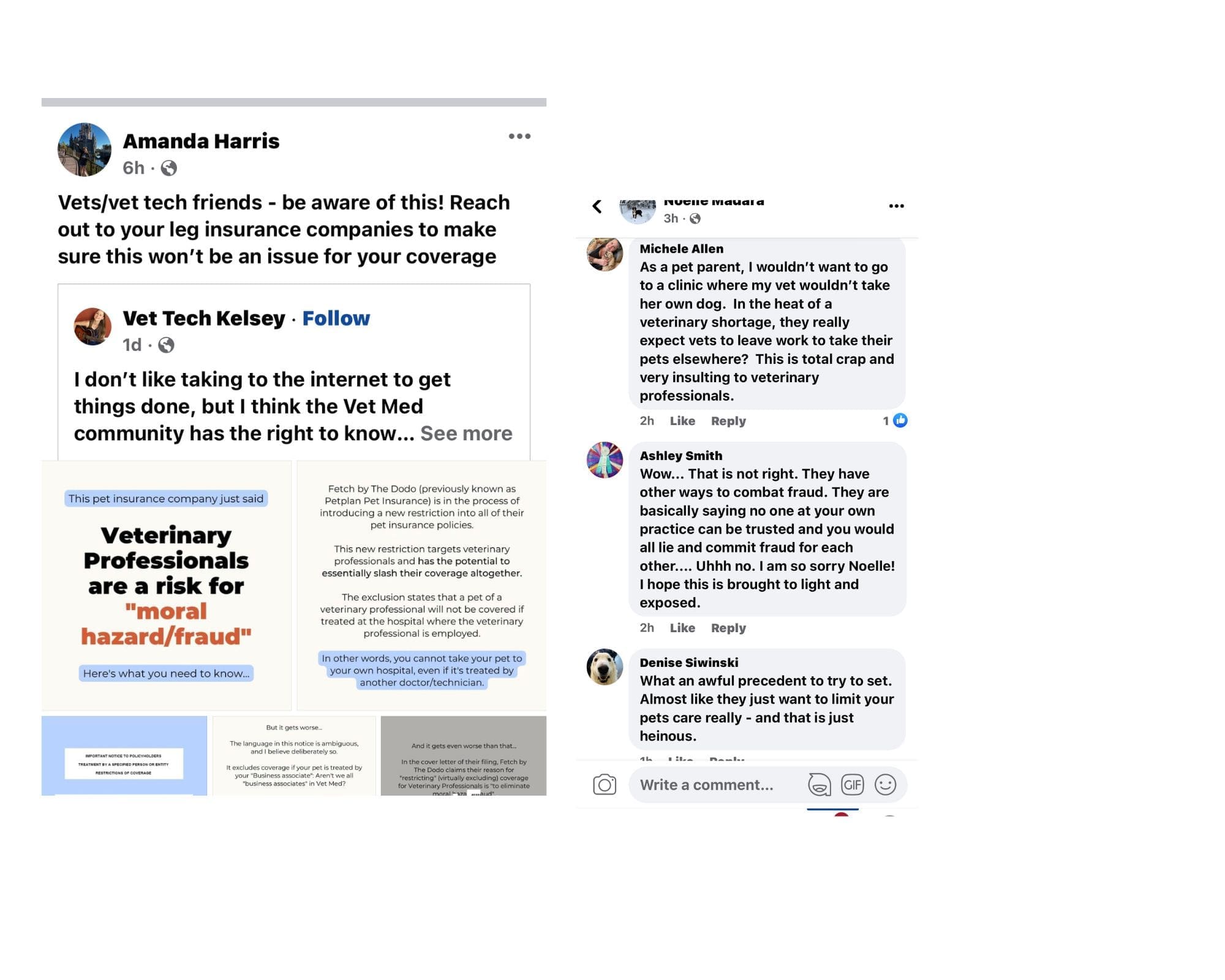

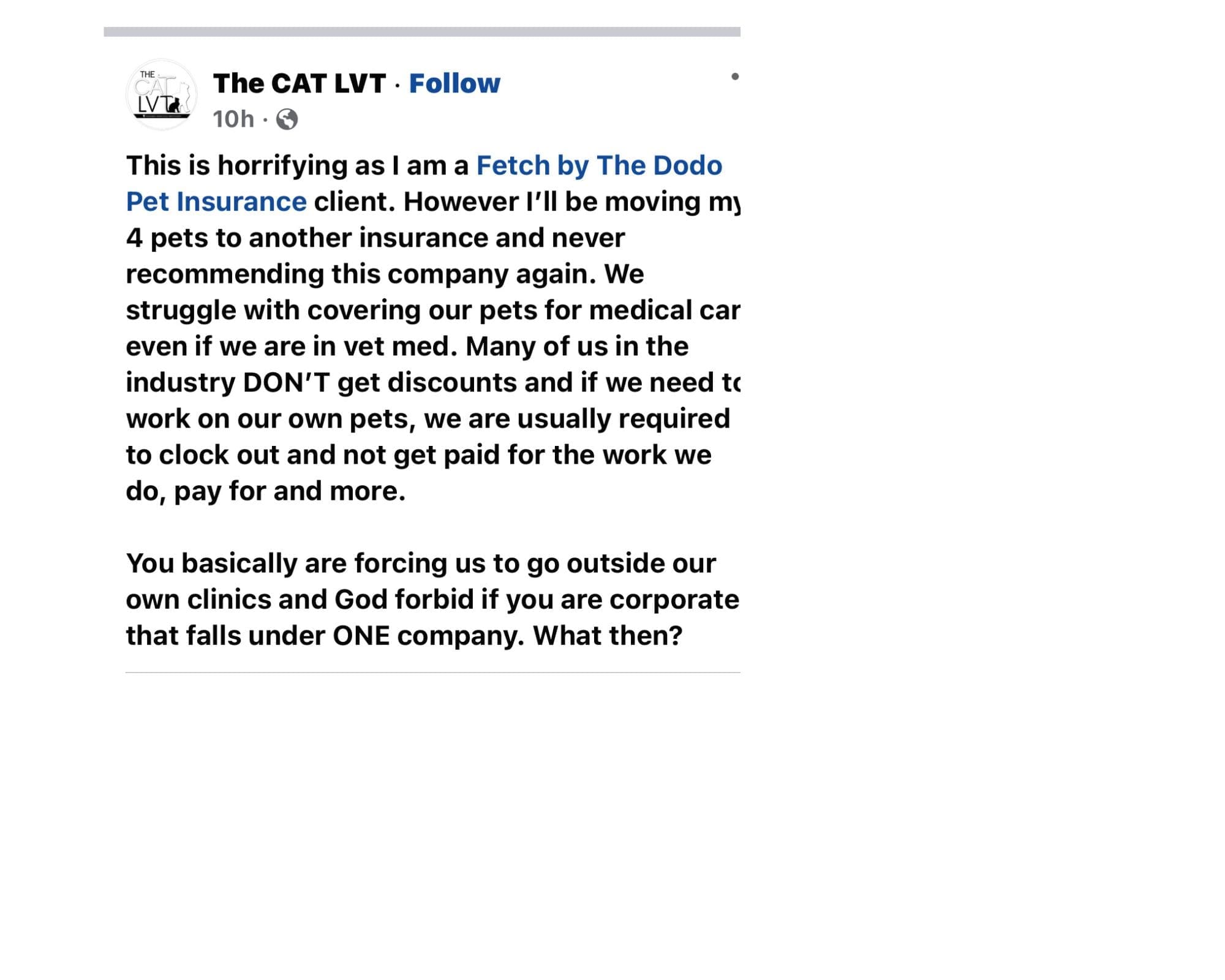

Social Media Mayhem

When TCR first uncovered and reported the news about Petplan’s plan to slash coverage for veterinary professionals, the result was a social media firestorm.

Consumer Liaison Calls on Regulators to Reject Petplan Filing

Center for Economic Justice (CEJ)’s Birny Birnbaum, the consumer liaison appointed by the National Association of Insurance Commissioners (NAIC) to sit on the Pet Insurance Working Group and has now called on Illinois and Virginia to reject Petplan’s filings.

“We ask you to reject this exclusion for two reasons. First, there is no showing that veterinarians, their family members or employees are more likely to commit fraud or present a moral hazard to the insurer. While veterinarians may be more familiar with pet insurance policies than most, an educated policyholder is certainly no basis for excluding coverage for that policyholder. Absent some evidence in support of singling out this group of potential insureds, the exclusion is arbitrary.

Second, an exclusion for an entire class of policyholders is improper. Even if there was some basis for excluding coverage for a particular type of risk, the appropriate method would be an underwriting guideline that prohibits coverage. With the approach taken by PetPlan, a policy can be sold that offers no coverage, which would be an unfair and deceptive act.”

Phyllis Oates, a Virginia insurance regulator who says she reviews pet insurance filings, offered a surprising response to Mr. Birnbaum by acknowledging, “this exclusion may limit an individual’s right to choose a veterinarian that is a relative or an employer of the insured” only to conclude, however, that “The Bureau” does not have statutory authority to approve or disapprove the filing. “Apparently, it is NOT counter to Virginia public policy or public interest to arbitrarily limit the providers a pet insurance policyholder may use,” Mr. Birnbaum huffed to TCR in an email, reflecting on the Virginia response.

Pet Insurance Carriers Stay Silent Apart From Trupanion

Petplan CEO Paul Guyardo refused a series of requests to comment as has his spokeswoman, Robin Shallow. Isabelle Lerer, The Dodo’s founder, has also declined to respond to emails sent to her personal address, including whether she supports Petplan’s policy exclusion impacting veterinary professionals. Brother Benjamin Lerer has also refused to comment. Jim Bankoff, Vox’s chief executive officer, has also refused repeated requests for comment (Vox is now the parent company of The Dodo), as has Vox president Pamela Wasserstein.

As TCR reported last year, Petplan’s Guyardo is the VC-installed CEO who replaced the company’s mission-driven founders, the Ashtons, whom investors forced out because they failed to deliver suitable profit margins.

Vets’ Group Stays Mum

More bad news for the veterinary profession: The organization one would expect to be most outspoken about the policy exclusion, the American Veterinary Medical Association (AVMA), the largest trade association for veterinarians, also had no comment for this story. Neither Dr. Gail Golab, the AVMA’s chief veterinary officer, nor Isham Jones, the AVMA’s general counsel, answered requests for comment.

As for the pet insurance industry’s trade association, the North American Pet Health Insurance Association (NAPHIA), the organization is staying out of the debate. Its executive director, Richard Faucher, who is also the founder of little-known pet insurer Toto, issued this statement to TCR:

“NAPHIA does not govern, prescribe, nor comment on any member company’s particular product filing in whole or part, nor takes a stance on any given member company’s risk tolerance in the underwriting of its products. Regulators in each state determine the appropriateness of any pet insurance product filing with respect to that given state’s regulations. NAPHIA continues to support a pet insurance marketplace that fosters stable, robust and innovative pet insurance products that serve a wide and varied set of consumers and their pet’s needs. NAPHIA continues to work with the NAIC and regulators on the advancement of standards via a model law for pet insurance. A model law is not intended to thwart innovation of products for a changing consumer needs landscape and the risk perils that may present over time.”

Trupanion President Condemns Petplan “Moral Hazard” Policy: “No Alignment”

Trupanion President Margi Tooth, speaking briefly by phone, said Trupanion, a major competitor of Petplan, has “no alignment” with Petplan’s cover letter language declaring veterinary professionals a “moral hazard.” However, and notably, no other pet health insurance providers would take positions as of press time when asked by email if they were comfortable with the “moral hazard” cover letter.

Dr. Carrie Jurney is a board-certified veterinary neurologist and practice owner living in the San Francisco Bay Area. Dr. Jurney is also a founding board member and president of Not One More Vet (NOMV), a 501 c(3) nonprofit whose mission is to prevent veterinary suicide and promote mental health and wellness in the veterinary profession. “We work with them pretty extensively at NOMV because their product is run by veterinarians,” Dr. Jurney said when asked what she made of Trupanion speaking out. “They are very veterinarian and veterinary professional focused and they’ve got good hearts over there. That’s who I insure my pets with. Because they behave that way.”

We trust the veterinary profession, which is why we would never contemplate putting that type of exclusion in our coverage,” Trupanion president Margi Tooth told TCR last week.

We trust the veterinary profession, which is why we would never contemplate putting that type of exclusion in our coverage,” Trupanion president Margi Tooth told TCR last week.

Media Elites Remain Silent

Founded in 2014 by former PETA board member Isabelle “Izzie” Lerer, who is the daughter of Huffington Post co-founder and former Buzzfeed chairman Kenneth Lerer (Mr. Lerer was also a key member of AOL’s leadership), The Dodo is now owned by Vox Media, which acquired Ms. Lerer’s brother’s company, Group Nine Media, the former parent company of The Dodo. Vox Media also acquired New York Magazine in September 2019. Ms. Lerer’s brother, Benjamin Lerer, the co-founder of Thrillst, sits on Petplan’s board of directors as Group Nine’s chairman (Group Nine is The Dodo’s parent company, which was acquired by Vox). According to The Wall Street Journal The Dodo-Petplan deal included an equity stake for Group Nine. Ms. Lerer would not respond to requests for comment sent to her personal email address, including about whether The Dodo was comfortable with the “moral hazard” cover letter language. Ms. Lerer’s brother, Benjamin Lerer, who co-founded Thrillst and helped engineer Petplan’s partnership with The Dodo according to Petplan CEO Paul Guyardo, also would not comment, nor would Dodo parent company CEO Jim Bankoff of Vox Media, Inc.

Update: The Dodo Implodes

Nine days following publication, The Dodo capitulated and said the insurer would be formally withdrawing the now infamous statutory filing.

Late Saturday, July 30, Petplan issued the following statement to the veterinary profession vowing to withdraw the policy:

After listening to those who reached out to us, we recognize that this exclusion had consequences on the veterinary community that we never intended. For that reason, we will not enforce the exclusion submitted to state regulators and will immediately begin the process to withdraw it completely.

Quite simply, there will be no changes whatsoever to your coverage, reimbursement or the manner in which you treat your pets.

In the coming weeks, we will also be introducing a veterinary advisory board that we’ll consult with before making any future changes to our insurance product and policy terms. This board will also ensure that we’re constantly listening and supporting your work.

We sincerely value our longstanding relationship with the community and recognize the invaluable role that vets, and vet techs play in maintaining the health and wellness of the pets we all love.

Thank you for bringing this matter to our attention

Full email exchanges, insurance rate filings, other documents referenced here: The Canine Review – Documents – Petplan/Fetch By The Dodo Reporting

Related: