Pet Insurance Industry 2021 Results Are In: Huge Growth Continues, but Most Americans Still Aren’t Buying

The pet insurance industry is reporting today that the total number of insured cats and dogs in the U.S. for 2021 (end of year) was 3, 979, 282, a 28.3% increase since 2020.

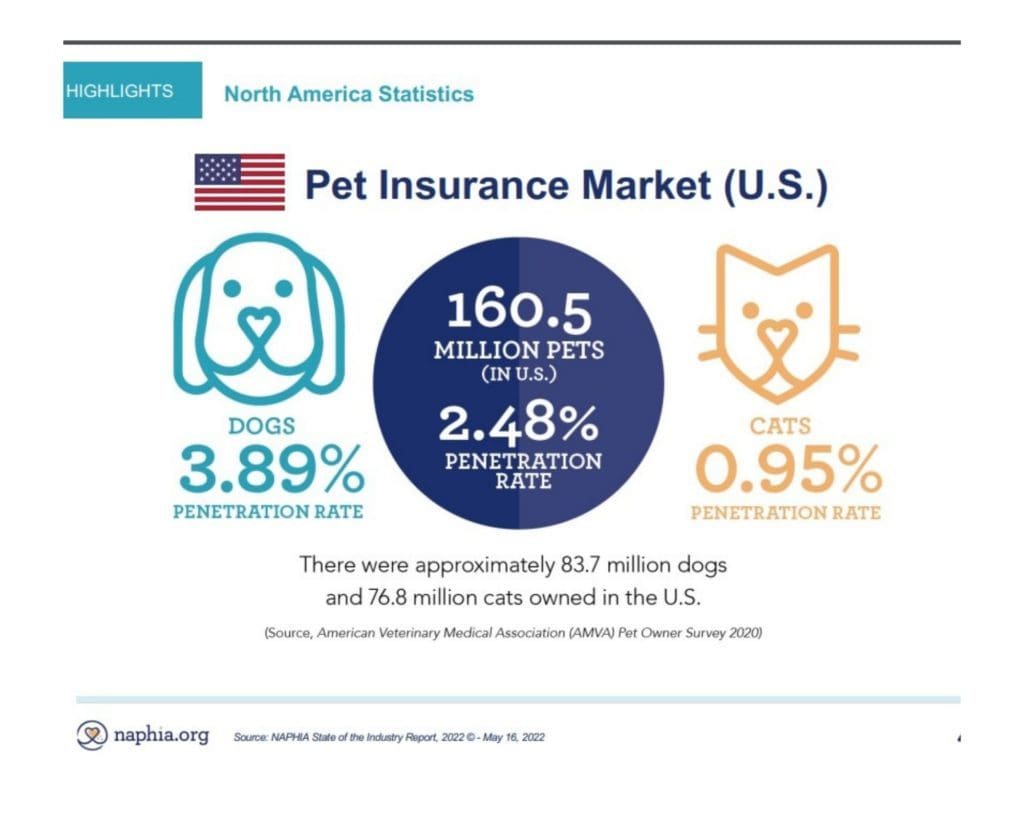

In their annual report to out this morning, members of the North American Pet Health Insurance Association (NAPHIA) report another year of terrific growth, rivaling any industry, including e-commerce. However, the percentage of American pets with health insurance – at less than 2.5% – is still dwarfed by the penetration rates of many countries in Europe. The percentage of pets insured in the United Kingdom, for example, hovers around 25%. In Sweden, the birthplace of the pet insurance industry, the number is reportedly north of 90%.

According to NAPHIA, there the 28.3% increase in the number of pets insured in the U.S. in 2021 brings the five-year average annual growth rate of insured pets to 21.6%. U.S. pets represented about 90% of North American insured pets, and dogs represent the vast majority of insured pets. In the United States, 81.7% of insured pets were dogs according to this year’s report. Like last year, California and New York are the two most saturated pet insurance markets. California’s insured pet population is at 19.3% followed by New York in a distance second place with 8.4% of its pets insured.

NAPHIA Executive Director Kristen Lynch told TCR last month that the report was delayed this year because, coincidentally, there were so many new members, and it was taking more time than usual to collect data from all of the newbies. When the same report was released last year, the industry reported the much-anticipated 2020 results from the pandemic pet boom: 3.1 million pets insured, up from 2.52 million in 2019.

Download NAPHIA report highlights here.

Why Americans continue to go without pet insurance despite rising costs for veterinary care is an ongoing debate, but most industry experts agree that the collective memory and ongoing experiences of many Americans with human health care and health insurance contributes significantly and understandably to American skepticism about health insurance for pets.

TCR’s report this week on AKC Pet Insurance/PetPartners/IAIC touting coverage of pre-existing conditions in its marketing as well as the findings from our consumer reporting that the company’s salespeople (at least two agents in two different calls) seem to be providing incorrect information that overstates a pet’s eligibility for coverage illustrates another significant contributor to ongoing skepticism about the market: deceptive marketing and fine print saturated with hidden clauses, which is why we are launching a new sub-section: “Paws and Clauses.”

Pet insurer “AKC” from PetPartners touts coverage of pre-existing conditions

More to come .