Nationwide Now Axing Pet Insurance Policyholders Everywhere.

As many as 300,000 pet owners are losing their pet insurance policies with Nationwide, including coverage of pre-existing conditions, by one former exec's estimate.

More reporting forthcoming. First story below:

“We’ve had Nationwide Pet Insurance for Lizzie’s whole life,” Alison Seltzer Friedman wrote on Facebook April 8. “When she turns 15 ½, they are canceling our policy. Please help me understand how this can happen.”

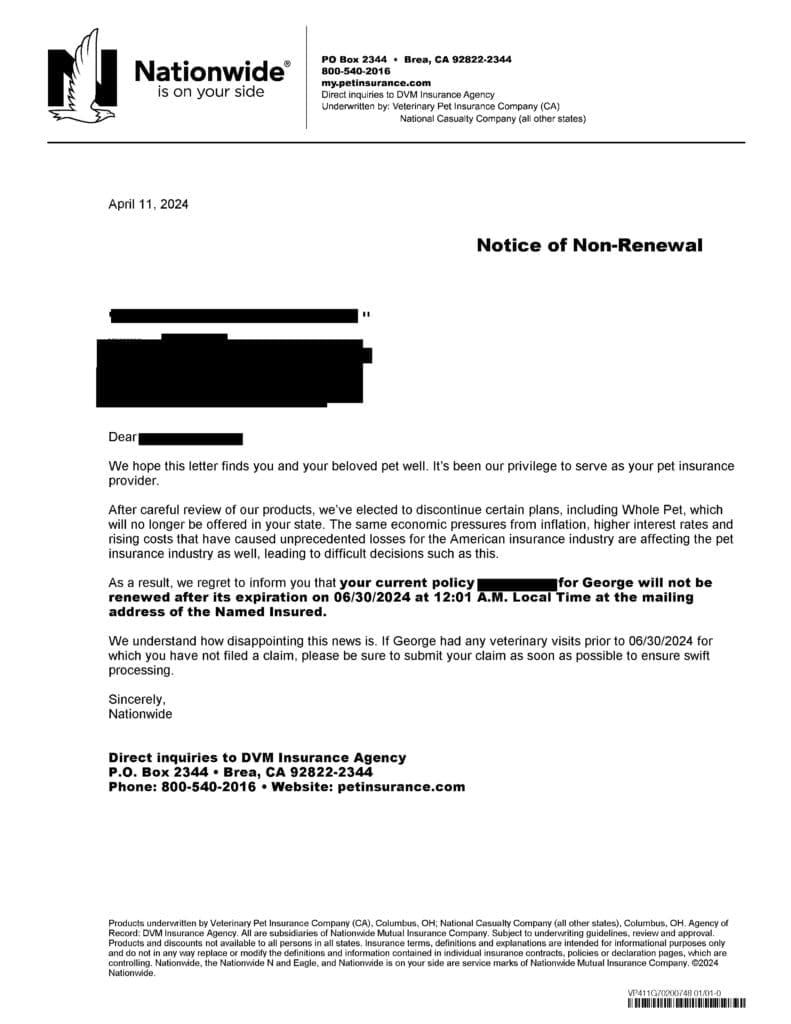

Nationwide has begun issuing non-renewal letters to policyholders of its pet insurance policies around the country. No official at Nationwide would respond to TCR’s requests for comment when asked which policies in which states would be non-renewed, or if the letters were targeting individual policyholders and/or states.

We asked Nationwide CEO Kirt Walker in an email if he could answer Ms. Seltzer Friedman’s request for an explanation. Mr. Walker did not respond to the request for comment about the Facebook post. Neither Mr. Walker, nor veterinary officers Jules Belson and Emily Tincher, nor spokesperson Karen Davis, returned requests for comment about how many policyholders would ultimately be impacted and in which states.

But one former Nationwide executive told TCR last month that the company is in the red: “In addition to Heidi Serota,” he wrote in an email, “one senior manager, two long term managers, plus approximately 20 other individuals were terminated,” he wrote in an email. “Heidi was in the senior position for about 5 years as were each of her two predecessors. The primary goal of each was to make Nationwide Pet profitable. Obviously that has not happened. Cancelling Whole Pet With Wellness policies is a pretty drastic step from a public relations perspective. I’m sure the pets protected under those policies are older and will be more difficult to insure by other companies.”

Another former pet insurance executive told TCR the number of policyholders this will impact will likely be at least 300,000. Nationwide has still not returned our requests for the numbers, and although pet insurance companies are finally required to report non-renewed policies and other data to regulators, that reporting is not available to the public unless it becomes part of an enforcement action.

NAIC Consumer Advocate Says Regulators Must Act

Asked to comment on Nationwide’s non-renewal letter, recently retired National Association of Insurance Commissioners (NAIC) consumer advocate legend Birny Birnbaum told TCR in an email:

“This is the long-term care insurance playbook — close out one product, offer the new product to folks with less likelihood of a future claim and leave those who paid for years out in the cold. Any regulator worth their salt would stop this action — it is essentially post-claims underwriting. Even if the justification about higher claim costs were true, then the solution is to file for higher rates.

This is precisely why consumers have so little trust in insurers. Trust us that we the insurer know what are doing when we offer you this policy. Oh, we didn’t really know what we were doing when we wrote this policy, but trust us now when we cancel your policy. Why should a consumer have any confidence that a couple of years down the road, Nationwide won’t pull the same bs on the new policy forms?”

“Any regulator worth their salt would stop this action…”

Another voice notably absent from this story: Nationwide Pet’s largest competitor, Seattle-based Trupanion, Inc. When asked to comment about the state of the industry and why consumers should trust any carrier, Trupanion founder and CEO Darryl Rawlings, along with president Margi Tooth declined TCR’s requests to comment. For several years, Mr. Rawlings appeared frequently in TCR’s stories and was constantly quoted taking policy positions about pet insurance regulatory work, always taking the opportunity to align “vet-centric” Trupanion with the interests of veterinarians. Trupanion, too, has gone through a series of changes recently. More on that to come.