VEG CEO Attacks Pet Insurers, Offers ‘No Solution’ For Those Who Can’t Pay Vet Bills Up Front

Late last month, veterinary hospital industry disruptor David Bessler hosted more than 200 veterinary students and recent graduates for a virtual question and answer session, “In The Know With The CEO.” The event was also attended by The Canine Review. We wanted to understand Dr. Bessler’s perspective on pet health insurance and why he had made the decision to turn away Trupanion’s direct payment software which, for now, remains the only pet insurance solution to the reimbursement model–that is, being asked to pay thousands of dollars up front and waiting days if not weeks to be reimbursed.

Dr. Bessler, who is an emergency veterinarian himself, is the co-founder and CEO of the well-liked Veterinary Emergency Group (VEG), launched in 2014 and now, says VEG, employs 2600 veterinary professionals in 40 emergency hospitals around the country. “VEG’s mission is to revolutionize the Veterinary Emergency industry and create a VEGolution!” its website declares. Dr. Bessler may be forward-thinking and progressive in some areas of management, but when asked about pet insurance and why he opposes Trupanion’s software in his hospitals during the Zoom Q&A, his answers seemed to ignore basic economics of both the human and veterinary healthcare professions.

“Client-centered,” except when clients wish to pay with insurance in real time?

According to a source familiar with VEG, VEG hospital administrators, as well as VEG clients, have called Trupanion and implored the carrier to install its software. The requests from pet owners and employees have persistently fallen on deaf ears. Dr. Bessler is staunchly opposed to allowing Trupanion’s software in.

Most veterinary hospitals require payment in full when a pet is admitted and in many parts of the country, critical care and surgery can easily bill in the five-figures. The cost of veterinary care, like everything, is rising sharply, perhaps even faster than other areas of the economy for good reason: unlike human healthcare in the United States, veterinary medicine is an industry that has persistently undercharged for its services.

According to the U.S. Bureau of Labor Statistics, the median salary for veterinarians in 2021 was $100,370. Dentists’ median salary was $163,220. Veterinarians are at least 2.5x more likely to die by suicide than the general population. They spend much of their lives in debt, working to pay off their student loans.

What about people who don’t have the money to pay upfront? I don’t have a solution for that,” he acknowledged.

So, what did Dr. Bessler say?

“Your concern is, what about people who don’t have the money to pay upfront? I don’t have a solution for that,” he acknowledged, but he didn’t want veterinary medicine to be like human medicine, a situation for which he says the human health insurance industry is to blame. “I know that I don’t want insurance to ruin the veterinary industry like it has in the human medical industry,” he added.

It may surprise you to learn that the health insurance companies, however insufferable with respect to the service they provide, are not, in fact, the entities at fault for the broken health care situation in America. In fact, they’re hostages of it, just like the rest of us. Still, insurance companies are an attractive target for blame.

“My wife is an optometrist,” he explained. “I have a lot of friends who are doctors and I watch over time how they attribute their increased dissatisfaction with their careers to the medical insurance industry.”

Few would take the position that United Health Care or Cigna provides a fabulous customer service experience, or that what’s covered by those providers is adequate. And the same can be said for many products in the pet insurance space. But the pet insurance space has several good products. And in dismissing how people can pay for healthcare – for their pets or for themselves – with insurance, Dr. Bessler is doing no one any favors, including his own business.

Human healthcare to vet healthcare: not an apples to apples comparison

- The human health insurance industry is battling the same war as American consumers–which is cost of care and, more specifically, the fact that pricing of healthcare is completely unregulated, putting the patients and the insurers both on the receiving end of outrageous bills.

- Dr. Bessler is leaving out other significant cost issues unique to U.S. human healthcare like medical malpractice litigation, something that had no bearing on the veterinary profession because pets are classified as property, not sentient beings.

- In 2013, my dad, coincidentally, was the journalist who wrote a reporting tour de force single-issue TIME story (the magazine’s longest story in its history), which asks one core question: How come healthcare costs in the U.S. – human – are so high relative to other wealthy countries when the results of that care are no better and often worse?

- “The most practical malpractice-reform proposals would not limit awards for victims but would allow doctors to use what’s called a safe-harbor defense. Under safe harbor, a defendant doctor or hospital could argue that the care provided was within the bounds of what peers have established as reasonable under the circumstances. The typical plaintiff argument that doing something more, like a nuclear-imaging test, might have saved the patient would then be less likely to prevail.”

- “When Obamacare was being debated, Republicans pushed this kind of commonsense malpractice-tort reform. But the stranglehold that plaintiffs’ lawyers have traditionally had on Democrats prevailed, and neither a safe-harbor provision nor any other malpractice reform was included.”

Dr. David Bessler

I guess the big question is this: if you think that human health insurance sucks the way it is today, I want to know why would pet insurance be any different? Why would they not try to do, what human health insurance companies are making a lot of money and our doctors and nurses are not making a lot of money like they used to.

And healthcare, the provider, like if you go to your doctor and they spend 30 seconds with you, cause they gotta move on to the next case because of human health insurance. So my question is, when has like veterinary health insurance said like, no, no, no, we’re not gonna do what human health insurance has done. They say it, they won’t put it in writing and we can’t hold them accountable for that. Why would they not get rich just like the human health insurance companies? Why would they not make the same exact move? We’d be idiots to just believe them. And when they say like, oh, we’re not gonna do that. Like, why would I believe them?

The Canine Review: I appreciate your taking my questions. Thank you.

Bessler: Yeah, I think it’s a great question. I think it’s really important. I mean, for me, hey, you can think it would be great. ‘Like, hey, let’s just like, now I don’t have to worry about people having money. I just take their pre-approval, they get paid directly. Like that’s it.’ It’s because I do have this kind of, I dunno, it’s like a moral north. I want to protect the veterinary profession. But thanks, it’s a great question.”

Pets are, for all intents and purposes, classified as property by law, which would make the kind of malpractice litigation in human healthcare next to impossible. One of the most compelling arguments against treating dogs more like people under the law is, in fact, the impact human-level malpractice litigation would have on veterinary medicine.

Put simply comparing pet health insurers – or at least some of them – to human health insurers is apples to oranges, because the pet insurers don’t face the sellers’ marketplace that human insurers face. To take another example, there is vibrant competition in almost every community among those providing veterinary care. But the same community, and its surrounding area, now typically has only one hospital system for people – which means that hospital can, and does, charge sky high prices to an insurer serving that community. After all, the insurer’s product will be worthless to patients in that area if that hospital’s services are not covered. So, the insurer has to pay, which means its customers have to pay. And which also means the insurer will be cutthroat about denying whatever claims it thinks it can deny.

‘The way they make money is by denying claims….’

That may be the way other pet insurers make money, but if you understand Trupanion’s business model, you realize it actually wouldn’t make sense for them to behave in the way that Dr. Bessler is describing because Trupanion’s business is centered around veterinarians. The company invested over $20 million and two decades into its patented software which requires sound partnership with the hospitals using the software.

As an aside, long before this reporter was covering Trupanion or the pet industry, I enrolled my high-energy bird dog Nellie in a Trupanion policy — and I was stunned. My astonishment over the extent to which it wasn’t a scam and, to the contrary, how much better my dog’s insurance was than my own coverage with United Healthcare, is what got me curious about pet insurance and led me into reporting on it. What began as a pet insurance reporting project developed into founding TCR.

“The way that a lot of insurance companies make money is by denying claims,” Dr. Bessler explained further. “You bought the insurance so that they would pay for medical care, but the way they make money is by denying the claim and holding on to your money as long as they can. I just don’t want to go down that route….My question is, when has veterinary health insurance said, no, we’re not going to do what human health insurance has done. They say it, but they won’t put it in writing and we can’t hold them accountable for it.” [Actually, I can hold Trupanion accountable for it and, yes, they’ve put their value proposition in writing many times. ]

Trupanion is one health insurer that not only doesn’t avoid paying claims, but pays them as part of a business model that envisions allowing patients to know that their claims will be paid as a way to make the veterinary industry more viable. The vet-centric insurer announced last week that it has paid out over $2 billion in veterinary invoices.

Pet Owners Demand Solution To Reimbursement Model

In its announcement of its $2 billion payout to veterinarians, Trupanion noted, “With our comprehensive coverage, unlimited payout, and the ability to pay veterinarians directly at checkout, Trupanion members can say ‘yes’ to the best treatment possible without worrying about the cost of care.” Dr. Bessler indicates later in the conversation that his quarrel is only with Trupanion because of the pre-approval service it offers. Yet, pet owners repeatedly indicate that the real-time payment capability Trupanion offers is the reason, for them, to buy pet insurance:

In the Facebook group “Pet Insurance Info Exchange,” discussions inevitably touch on the issue of reimbursement versus “direct pay,” the latter of which only Trupanion offers. “The reason I want pet insurance,” Alex Pescador commented in December 2022 in a discussion about pet insurance on Facebook, “is because I can’t afford a $3000 emergency, nor would I be able to pay out of pocket in order to be reimbursed 2 weeks or more later. Seems like a moot point to buy something I wouldn’t even be able to use.”

“Help me understand. I don’t understand the point of pet insurance if you have to pay up front,” Kathleen Campbell of Oakland, CA commented in a November 2020 Facebook discussion about pet insurance. “A lot of people don’t have a spare $20,000 on hand to pay an emergency bill, even with reimbursement.”

Post Script: A reader asks, how many hospitals are using Trupanion's software? Is Dr. Bessler an outlier?

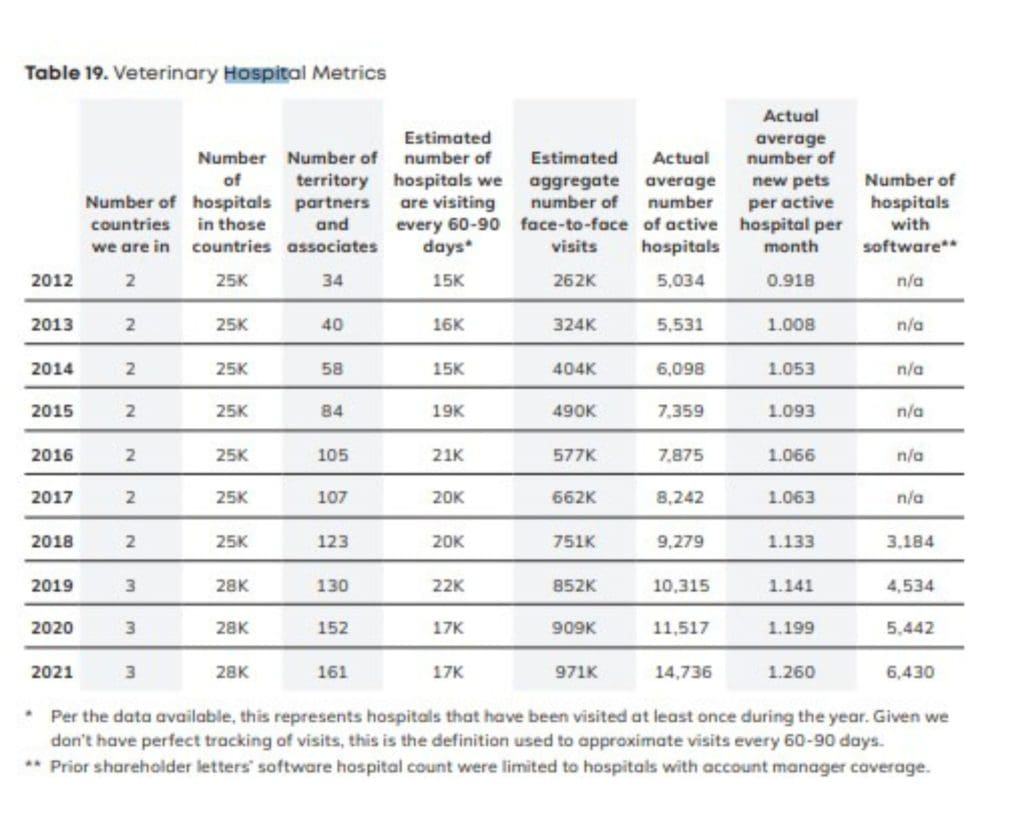

Following publication, a reader asked for data concerning percentages of veterinary hospitals using Trupanion’s software to provide context as to whether VEG was an outlier. When asked for data pertaining to veterinary hospital software use, Trupanion President Margi Tooth declined to provide it through spokesman Michael Nank. However, according to the company’s most recent shareholder letter released last spring, Trupanion’s software is installed in 6,430 hospitals or about 1/5 of all hospitals in the United States. It may seem like a small portion, but the company’s battle is precisely this misperception and misunderstanding of healthcare economics. The fact that the company is in over 6,000 hospitals is no small feat. But without question, the company could and should have a larger presence. The U.S. pet insurance industry’s greatest barrier to growing its market penetration rate beyond the rougly 3 percent of pet owners where the rate has stagnated may be the fact that the industry also seems to be stuck in the reimbursement model. Only one carrier, Trupanion, has developed a solution, yet the software solution is only in 1/5 of hospitals. The onus falls primarily on Trupanion to get that number way up, but idealogical opposition to solutions, as Dr. Bessler has expressed, are doing nobody any favors.

From Trupanion’s 2021 shareholder letter: