AKC Pet Insurance/PPI promises “most comprehensive” pre-existing condition coverage, but CEO declines repeated requests to discuss policy

What’s In A Name?

Despite the reassuring name of AKC Pet Insurance, The American Kennel Club is not responsible for the administration, marketing, sales, or underwriting of this insurance –at least, not directly responsible. Instead, the AKC, the world’s largest registry of purebred dogs, founded in 1884, allows a private equity backed insurance company called PetPartners (PPI) to sell insurance to new owners of purebred puppies when they register their new additions after arriving home from their breeders, thereby using the AKC’s deservedly prominent branding in exchange for a licensing fee.

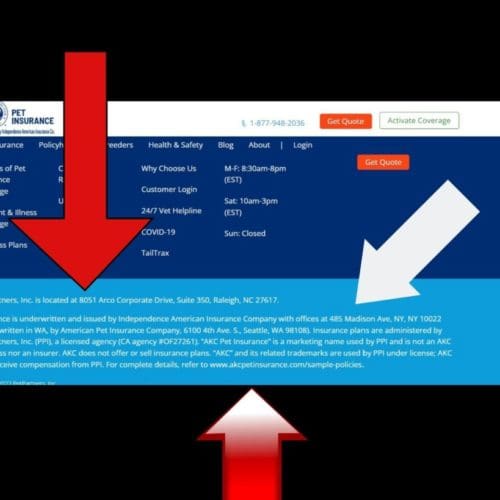

A small-print disclaimer (see above) on the bottom of AKC Pet Insurance’s website (after a long scroll down the page) states in part:

“AKC Pet Insurance” is a marketing name used by PPI and is not an AKC business or an insurer. AKC does not offer or sell insurance plans. ‘AKC’ and its related trademarks are used by PPI under license; AKC may receive compensation from PPI.”

In other words, if the owner of a new puppy who has just registered the puppy with the AKC next enrolls in AKC Insurance, AKC gets a cut. The chance of that is maximized by a marketing campaign wherein anytime a person buys a puppy from an AKC registered litter and submits the puppy’s AKC registration papers, the AKC allows its PPI insurance partner to “remind” the new owner to activate the insurance (explained by AKC Pet Insurance/PPI on a sub-section of its website directed at breeders — see above).

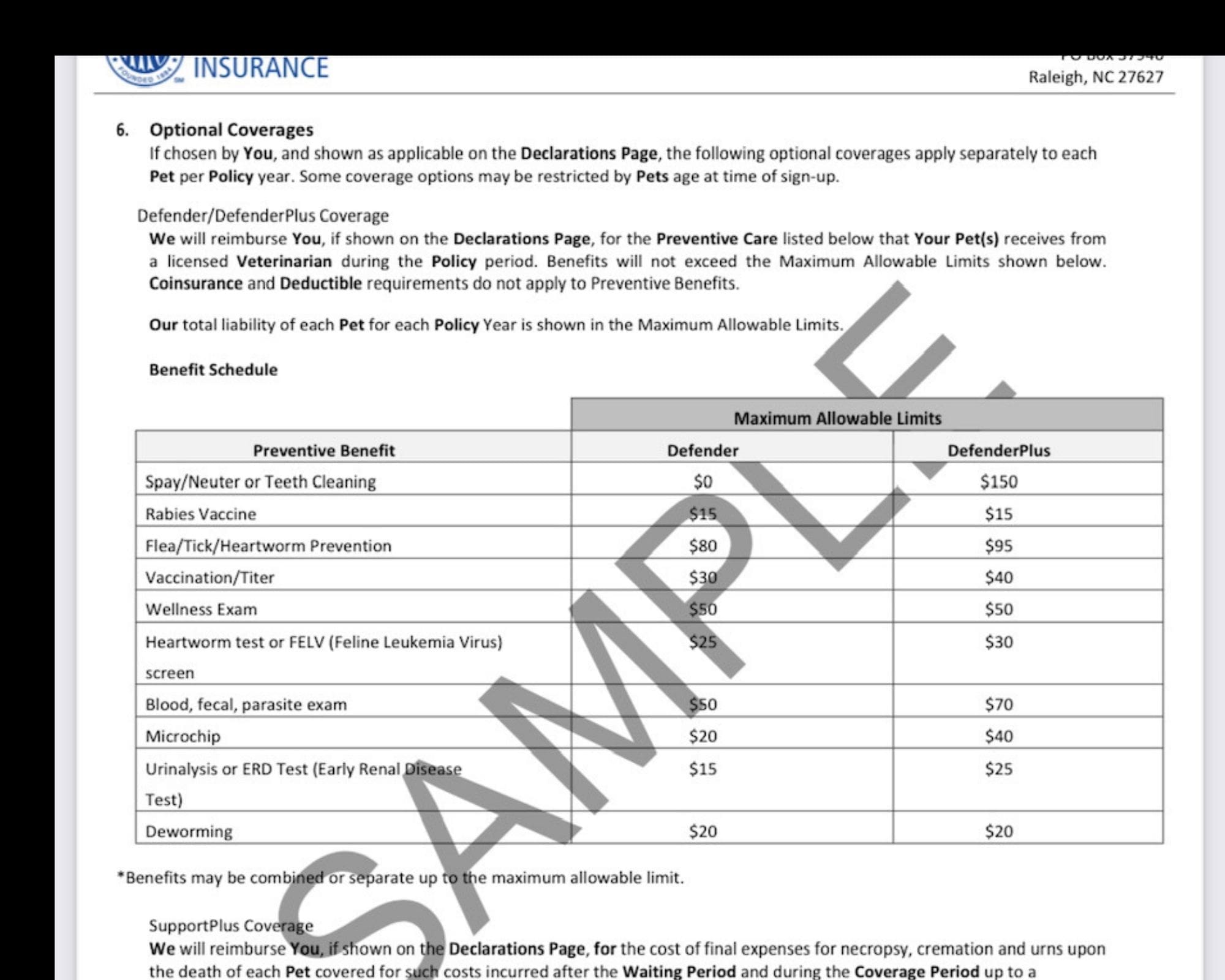

The language continues:

“If your puppy buyer forgets to activate,” AKC Pet Insurance explains to breeders on its website, “we will remind them of the benefit with an email one day after registration.”

I was reminded recently that the AKC allows PPI to sell AKC Pet Insurance to unassuming new owners of newly AKC-registered puppies when my parents added a new Labrador puppy to their lives from a wonderful breeder in Maine who gave them their last Lab sixteen years ago. For fees which neither the AKC nor PPI would disclose when asked, the registration packets mailed home to newly registered puppies include marketing from PetPartners/AKC Pet Insurance. And, to put it succinctly, AKC Pet Insurance does not provide the kind of insurance you or I would or should expect from a deservedly prominent institution like the AKC, which is why good breeders like ours aren’t to blame for assuming it did.

AKC president and CEO Dennis Sprung did not return emails seeking comment when asked about AKC’s relationship with PPI or whether he was comfortable with PetPartners’ use of AKC’s branding to sell pet insurance that seemed to be overstating its value proposition in its marketing of ‘comprehensive coverage of pre-existing conditions.’

What is PetPartners, Inc. (“PPI”) ?

Until June 2021, PetPartners, Inc. (“PPI”) was the pet division and subsidiary of insurance conglomerate Independence Holding Company (NYSE: IHC). In June, IHC sold 85% of PPI to a group of investment bankers, who call their entity Iguana Capital, Inc.

Why Not AKC Pet Insurance?

Long before I started reporting on the pet industry, including pet insurance, I became a consumer of pet insurance, but it was frustratingly late – too late for coverage of Nellie’s knee injury. It sounds trite, but this wasn’t just any knee injury. Like everything involving Nellie, it was complicated and obscenely expensive. Even if I had been informed and fortunate enough to have signed Nellie up for pet insurance when she first came home, many of the insurance products in the market, including AKC Pet Insurance, have limits, exclusions, and waiting periods. Nellie’s injury would not have been covered even if we had bought insurance, in other words. My discovery of Trupanion and my having to face the fact that I didn’t enroll Nellie until she was more than two years old — several pre-existing conditions, and thousands of dollars in vet bills later — is largely what inspired TCR. How could I not have known and why didn’t anyone else seem to know? And how were the cheaper, less reliable products winning any customers?

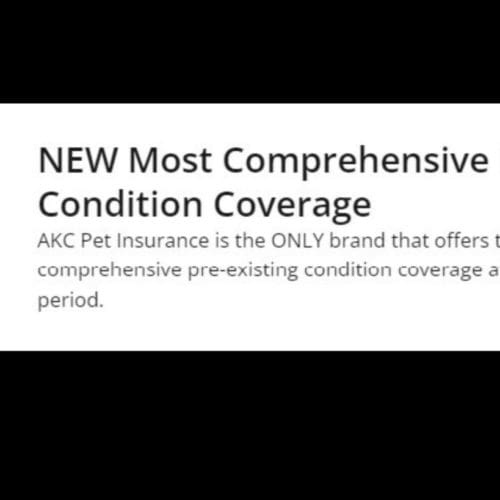

Magic Words: Comprehensive Coverage of Pre-Existing Conditions

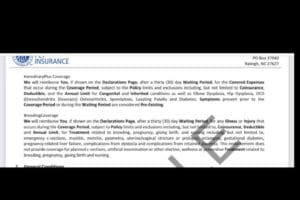

PPI’s small print disclosure that AKC Pet Insurance is only lending its name to insurance sold by a subsidiary of a conglomerate of insurance products that do not relate to pets may not be immediately noticeable on the AKC Pet Insurance website. However, the headlined declaration on the top left corner of the site that AKC is “the only pet insurer to cover pre-existing conditions” certainly stands out.

That’s because no pet insurer covers pre-existing conditions, including AKC, as careful readers will discover if they notice the asterisk at the end of that headline, which takes a careful reader down to the bottom of the page where AKC Pet Insurance (PPI) wiggles out of that promise by disclosing, “Pre-existing condition coverage requires a 12-month waiting period.”

Here’s how Nationwide Pet’s once lead actuary Lori Weyuker explained why the coverage of pre-existing conditions by pet insurers is so unlikely, quoted in 2018 in Contingencies, a periodical published by the American Academy of Actuaries:

“Insurance companies in the pet insurance business need to ensure that ongoing risk is sustainable,” Weyuker said. Pet insurance, being a purely optional purchase, “would encounter vast anti-selection [meaning owners would wait for a pet to have a condition before buying] unless there is a protocol to deal with pre-existing conditions in pets” if that were the case, she said. And the still-nascent pet health insurance industry is relatively unregulated—compared with human health insurance, which has pre-existing condition coverage generally mandated under the Affordable Care Act.”

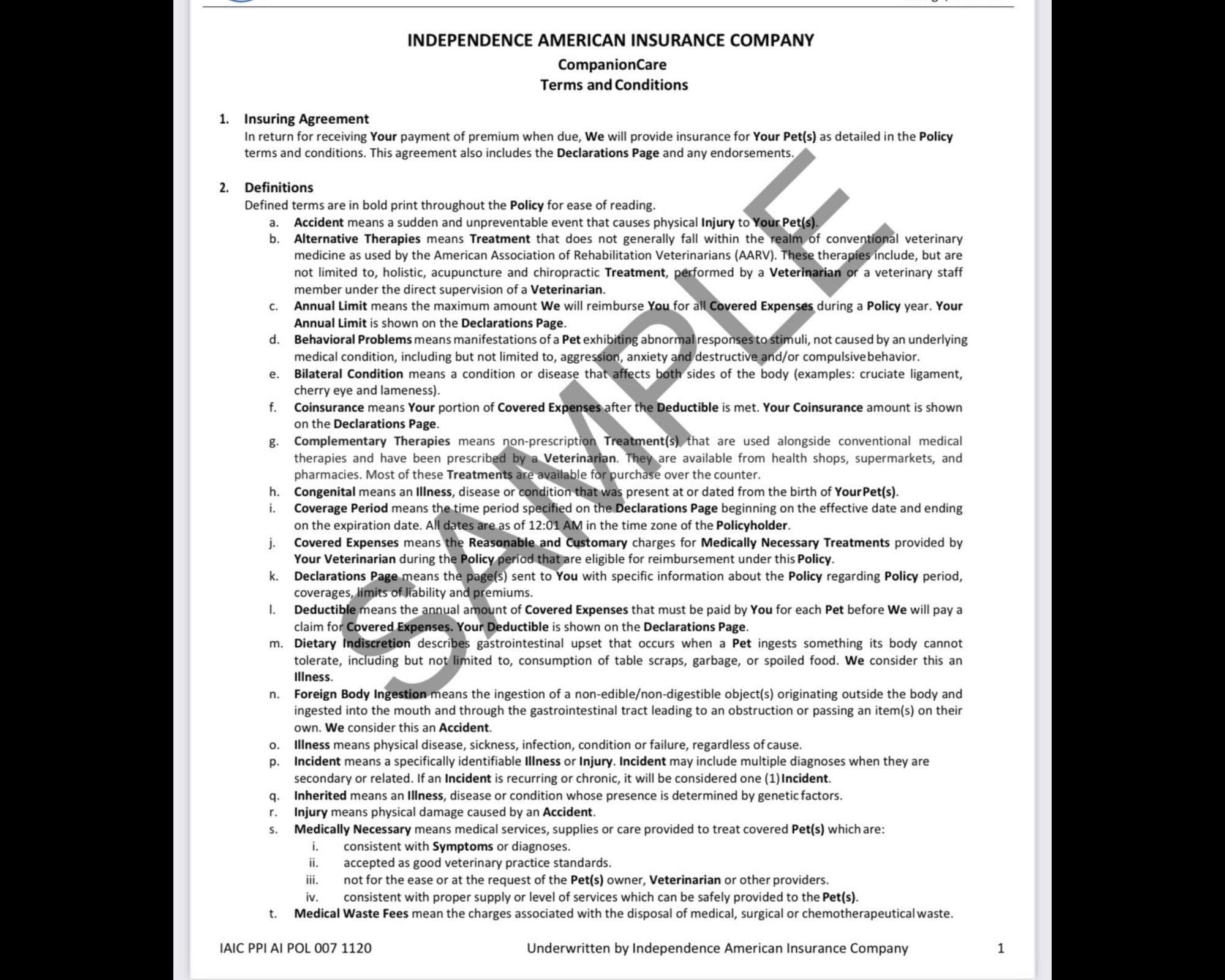

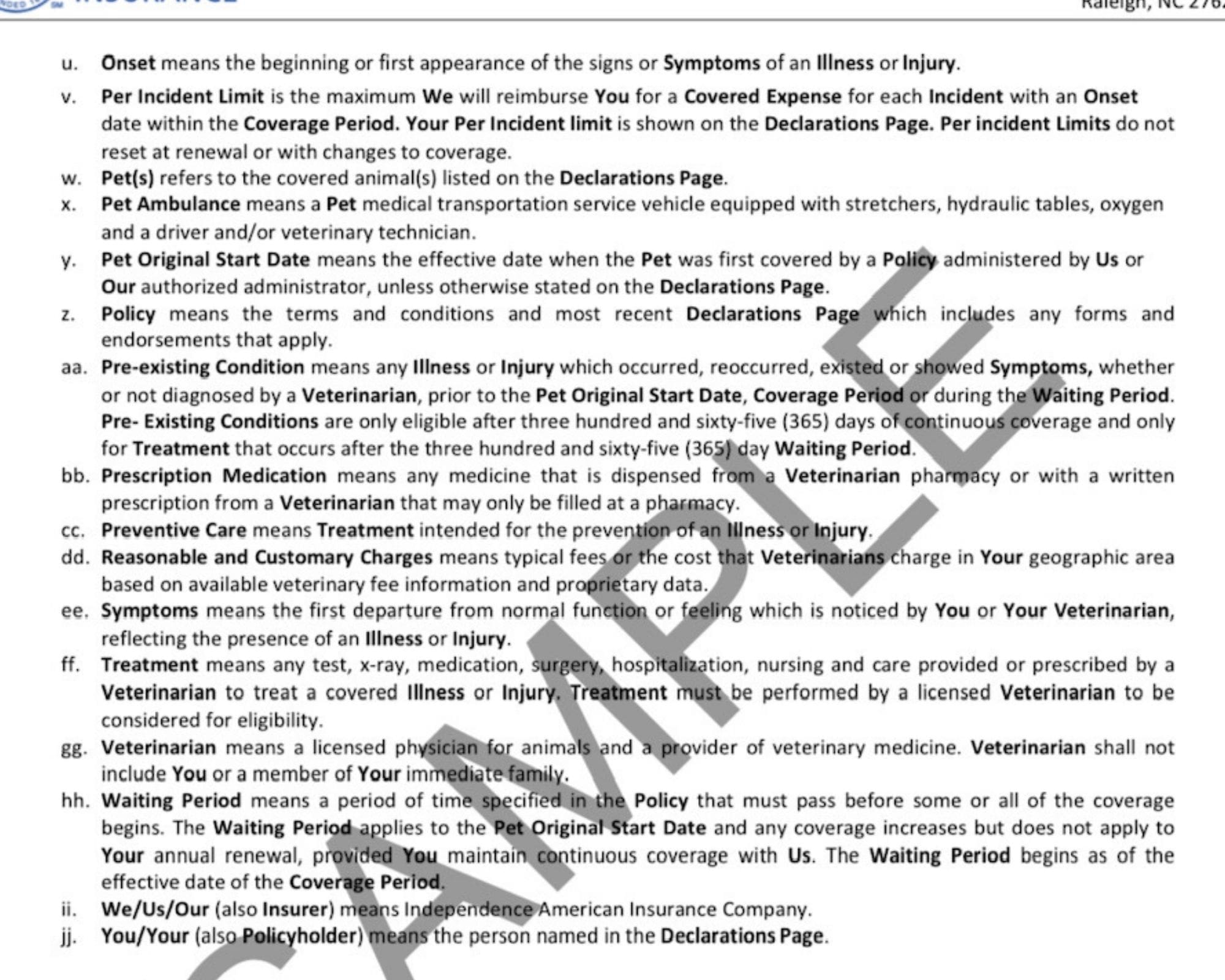

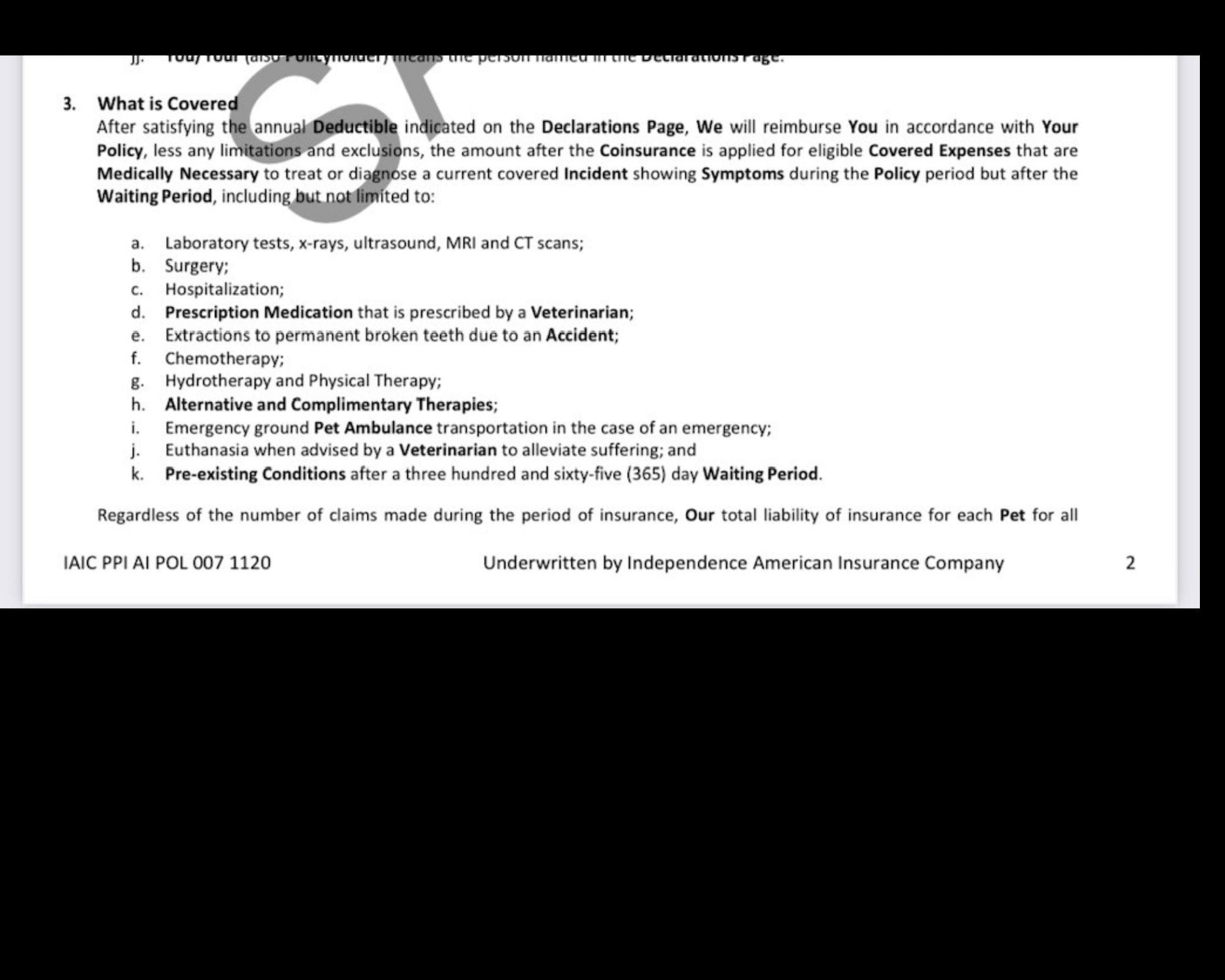

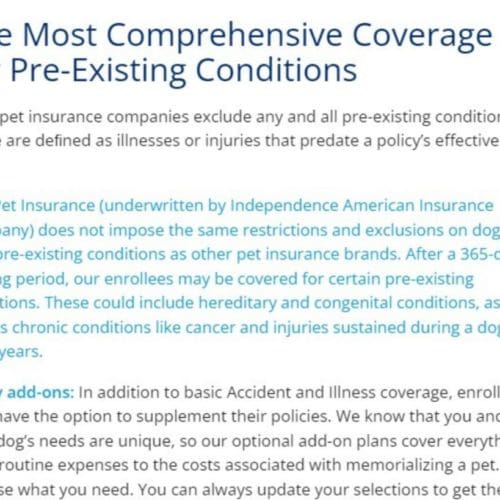

The Fine Print: What Does PPI Actually Say?

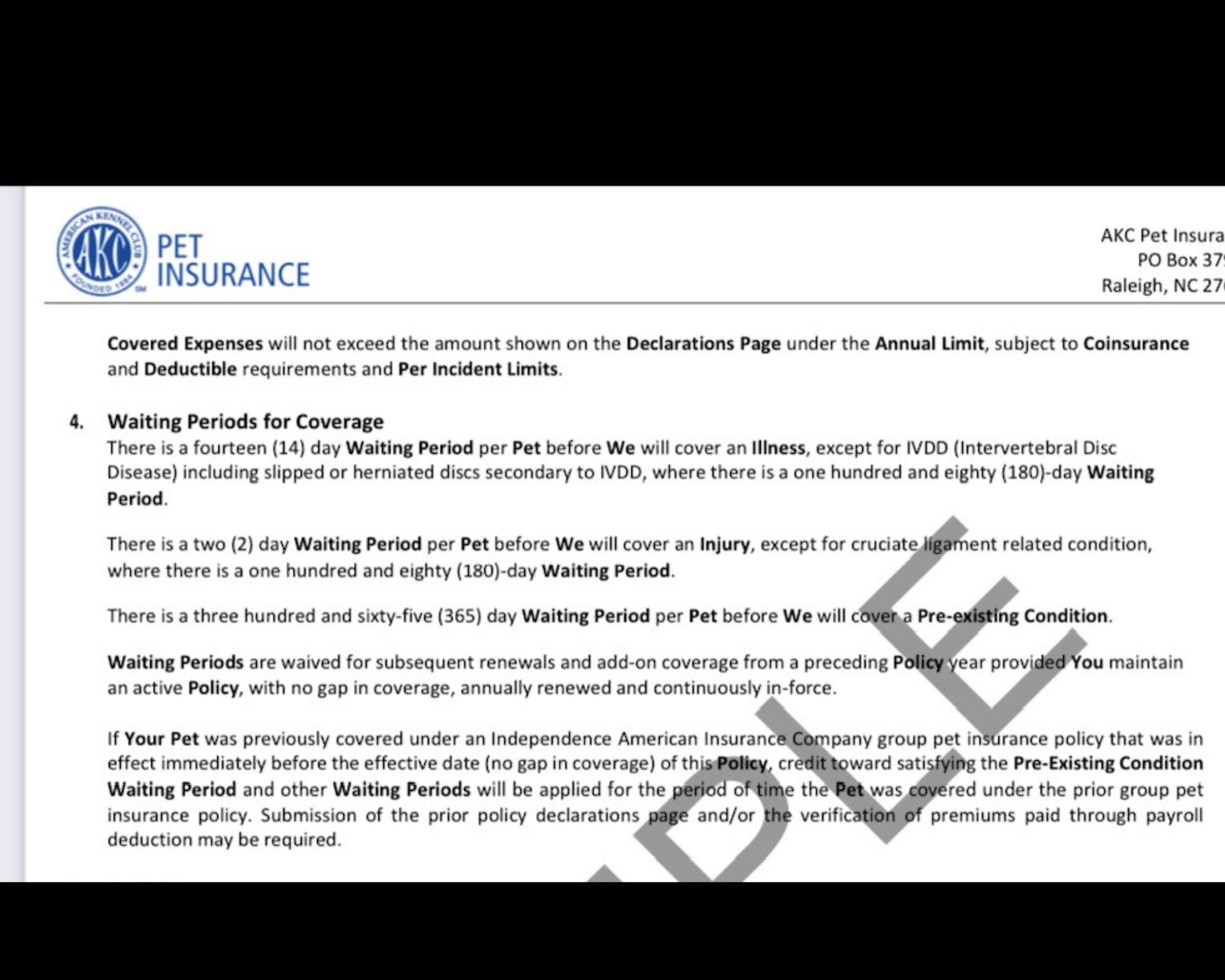

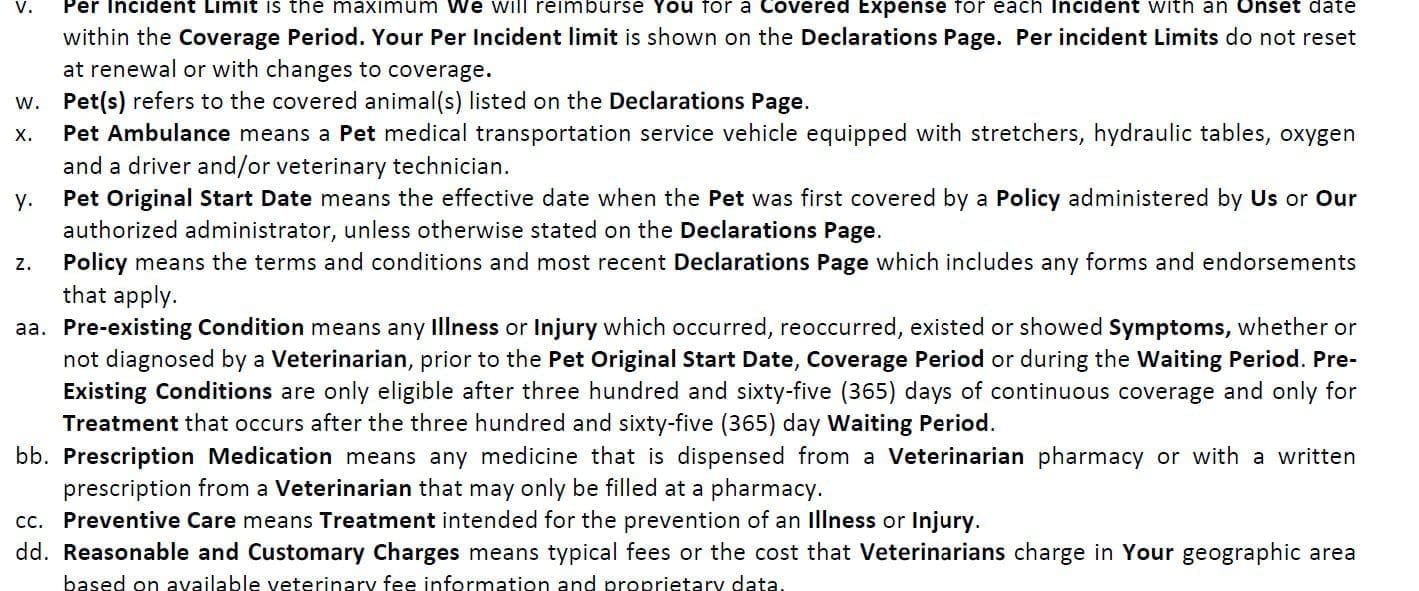

The policy says if condition X occurs during the 365-day pre-existing condition waiting period, it is not eligible. Only “Treatment that occurs AFTER [emphasis TCR’s] the three hundred and sixty five day waiting period” is eligible. Thus, even PPI’s own fine print even seems to indicate that it would not cover conditions that its salespeople told TCR in three different conversations with different representatives it would cover.

And here’s the kicker: PPI’s leaders refused repeated requests to discuss any of our questions over more than two weeks of attempts to get help clarifying the policy language. Put another way, it’s notable that no human including PPI’s press aide would discuss PPI’s coverage in live conversation. As for PPI’s leaders, we were met with total radio silence. In other words, if any of PPI’s leaders did feel that the AKC Pet Insurance’s policy fine print did support the marketing claims, including promises of ‘comprehensive pre-existing condition coverage,’ those leaders did not share those sentiments with The Canine Review. They refused numerous attempts to discuss specific questions about pre-existing condition coverage.

Above is a screenshot from the AKC Pet Insurance fine print. Again, not the wiggle-room language about the “waiting period.”

How Do Salespeople Explain It?

In three conversations with sales agents for AKC Pet Insurance, we were told that the 365-day waiting period does not require the pet to be asymptomatic of the condition to be eligible for coverage. But, again, that’s not what the small print seems to say.

Of course, it could also be that we’ve misread the fine print, and that the salespeople have accurate information. But TCR has no way of knowing that because no executive or spokesperson at PPI will discuss the policy in a live conversation. Only the salespeople will talk about it if we call them undercover. And, again, what they say seems to contradict the small print.

To hear how the company’s salespeople explain the policy to consumers, The Canine Review made these calls without identifying ourselves as media. (The press ethics rationale is that this constitutes consumer reporting; the scenario is analogous with a restaurant critic not identifying his or her affiliation. By default, once we identify ourselves as reporters, we are no longer in a position to experience the service or product as consumers.)

Here’s an excerpt from one conversation:

EB: That’s what I’m confused about because your website—I thought no pet insurance company covers preexisting conditions ever. So, I don’t understand—

Agent: The majority don’t. We just recently updated all terms and conditions so that we could.

EB: When you say there’s a 365-day waiting period, what’s the purpose?

Agent: Right. Let’s say, um, I mean, in the example of allergies, if my, if, for example, my dog didn’t have any symptoms of allergies for 365 days, she could conceivably get coverage for her allergies.

Agent: So, for that particular condition for the first year, if you submitted any claims, it would not be considered reimbursable for you. You would have to have the policy for that full year, but once your policy renews with us, any future treatments or diagnostic measures, that’s recommended by your vet for the allergy condition could be considered reimbursable to you. And that would just be subject to the deductible and reimbursement rate that you choose.

EB: So, even though, even though it’s in her records that she’s been diagnosed with allergies, she could get coverage.

Agent:

Correct. It would just take that one year before we start reimbursing towards it.

Both David T. Kettig, who joined Iguana Capital, Inc., which acquired a controlling interest in PPI as its Chief Executive Officer in 2021 and Lane B. Kent, PPI president, refused repeated requests to speak about the policy.

PPI would only provide an email from press officer Amanda Trcka, who did not attach telephone contact information:

Our product doesn’t have a “cured period” – meaning we do not require a condition to not show symptoms for a certain time period before its covered. This is different than other pet insurance offerings which may require a condition to show no symptoms for X amount of time before its covered.

For example, you start your policy on 1/1/21, and your dog had shown symptoms and was diagnosed and treated for allergies before their policy began. During their first policy term, claims for their allergy treatment would not be eligible. However, after you renew your policy for the following year, claims for your dog’s allergy treatments that have a date of service after 1/1/22 may be eligible (pending your specific policy, medical records, etc.).

Ms. Trcka mentioned “cured condition eligibility,” which is what some pet insurers have added in their fine print as part of what they offer. For example, U.S. Fire Insurance, which underwrites most of the pet insurance brands administered by Crum and Forster such as FIGO, Pumpkin, ASPCA Pet Insurance, and Spot, offers this precise language that is seemingly designed to avoid consumer confusion: “CURED CONDITION ELIGIBILITY.” Here is text from U.S. Fire Insurance’s boilerplate accident & illness policy:

There is a 14-day waiting period for: diagnosis, treatment or surgery related to accidents, [illnesses] and ligament and knee conditions. The waiting period begins on the first effective date of the applicable coverage. Any condition that occurs during an applicable waiting period is a pre-existing condition.

{“Illnesses” will only appear if the coverage selected includes these benefits and the applicable Waiting Period}

CURED CONDITION ELIGIBILITY

If your pet’s pre-existing condition is curable and has been cured and free from treatment and symptoms for a period of 180 days it is a new occurrence. This does not apply to ligament and knee conditions.

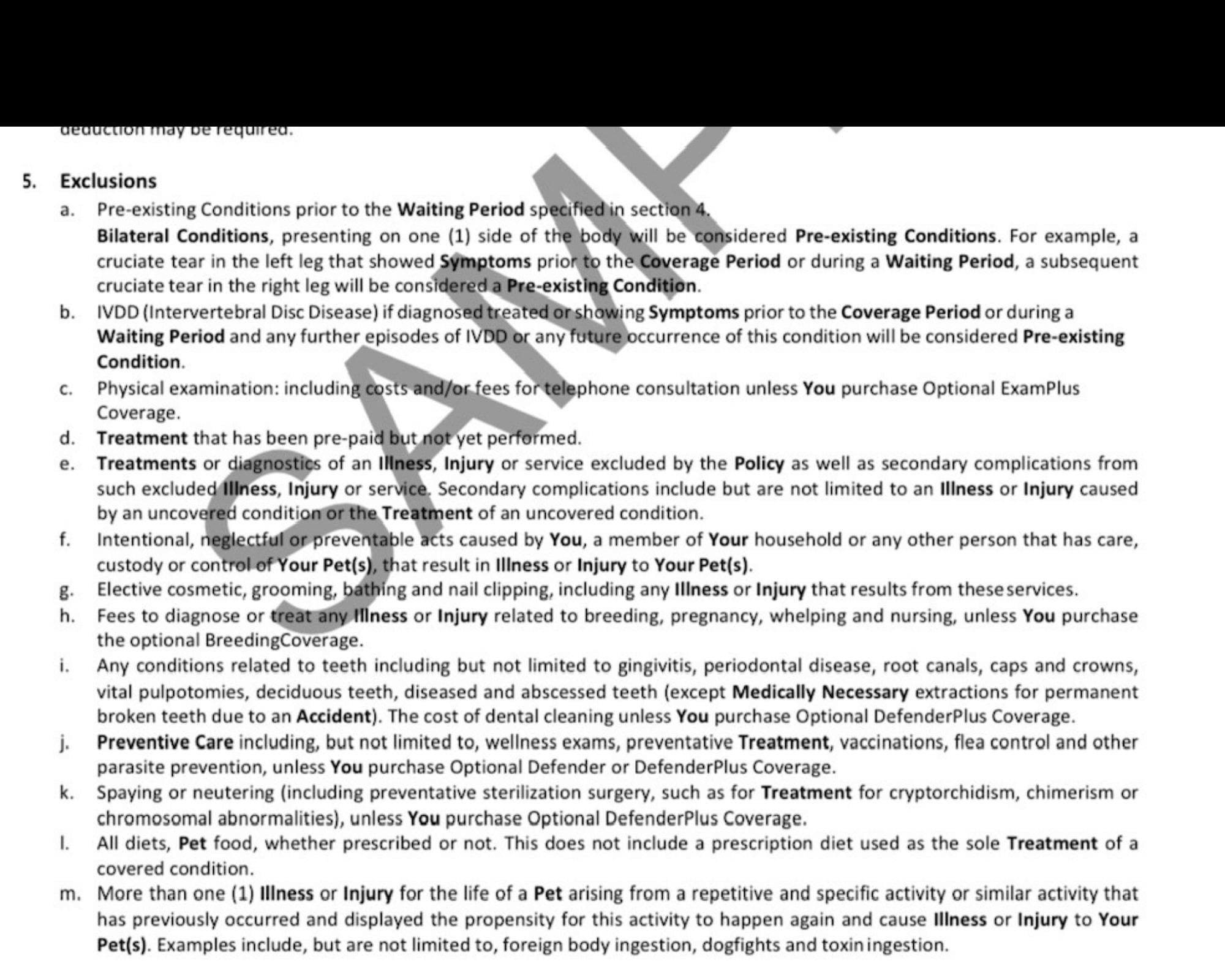

That clause about conditions occurring during the waiting period left me wondering: What if my dog has a pre-existing condition before I sign up and then it occurs and gets treated during AKC’s 365 waiting period. Clearly it will not get reimbursed during the 365-day waiting period. Will it get reimbursed AFTER the 365 days if it recurs? Under the U.S. Fire policies, it clearly would not. The AKC fine print at first look seems not address this – and the sales people told me that my pet would be covered. But look more closely at that fine print: It does say that pre-existing conditions also include conditions that occur “during the Waiting Period.” So, the answer seems to be no coverage after the waiting period, either! In other words, it appears from the small print that any pre-existing condition that occurs – whether treated or not – during any 365-day period is never covered.

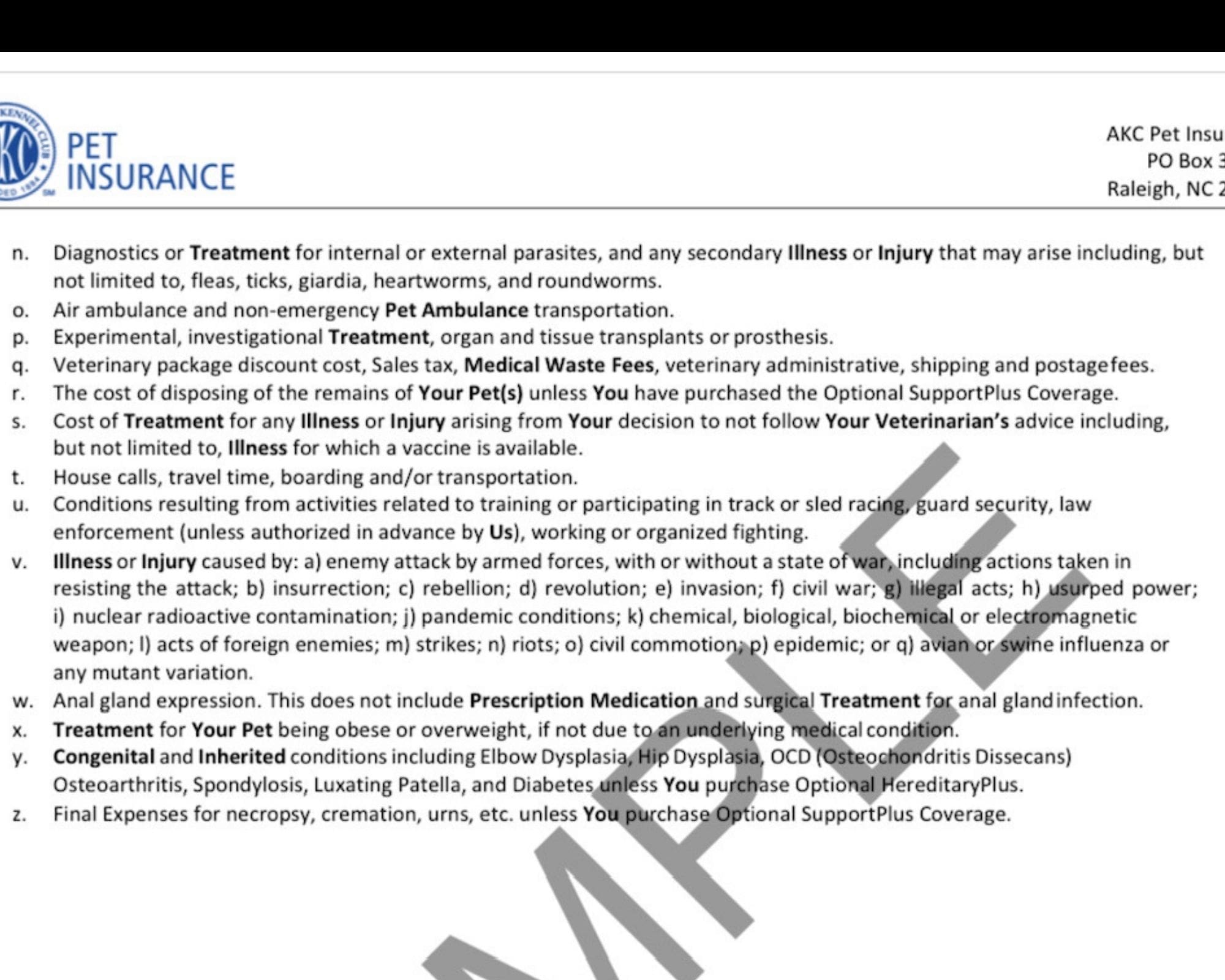

How Insurance Companies Insure Themselves

There’s another, arguably more telling and familiar problem with AKC Pet Insurance: “cancel” clauses, that is language that is neither highlighted or even mentioned in any marketing despite the exhaustive, sweeping legal implications, including the fact that the language is unambiguous. In the case of AKC Pet Insurance/PPI, the policy’s fine print includes several “cancel” clauses affording the insurer broad discretion to cancel/not-renew at any time without any reason. This seems to be the converse of a pre-existing condition exclusion. Here, one can lose a pet’s insurance coverage at renewal time if it has had a new condition.

“Shitty Language”

No insurer is beyond reproach in this regard, not even Trupanion, whose lower-tiered products in Canada include similar escape hatch ‘cancel’ clause language. Trupanion is in the unique position, however, of being the only pet insurer whose U.S. fine print is 100% devoid of any such ‘cancel’ language.

When asked about the Canada boilerplate pictured above, Trupanion founder and CEO Darryl Rawlings and President Margi Tooth denounced the “shitty language” (Rawlings called it) in live, on record interviews and maintain that the language is in the process of being removed. Randy Valpy, the person at Trupanion responsible for its Canadian products, maintains that the language — specifically, the “material change” clause which means the insurer can cancel if the dog’s costs ‘change’–“was an oversight on my part.”

Indeed, the language was not in the boilerplate when the products launched, which The Canine Review covered in real-time and would have noted in our reporting had we found such language in the original policies. Valpy says he wrote the policy wording based on “prior experience running two different pet insurance companies in Canada.”

But what if an insurance company was unapologetically deceptive with no hint of intent to remove its “shitty language”? For example, is there anything in PPI’s policy that stops the insurer from canceling one’s policy after the 365-day waiting period is completed?

We asked PPI’s leaders, including Iguana CEO David Kettig, exactly that, and have not received a response.

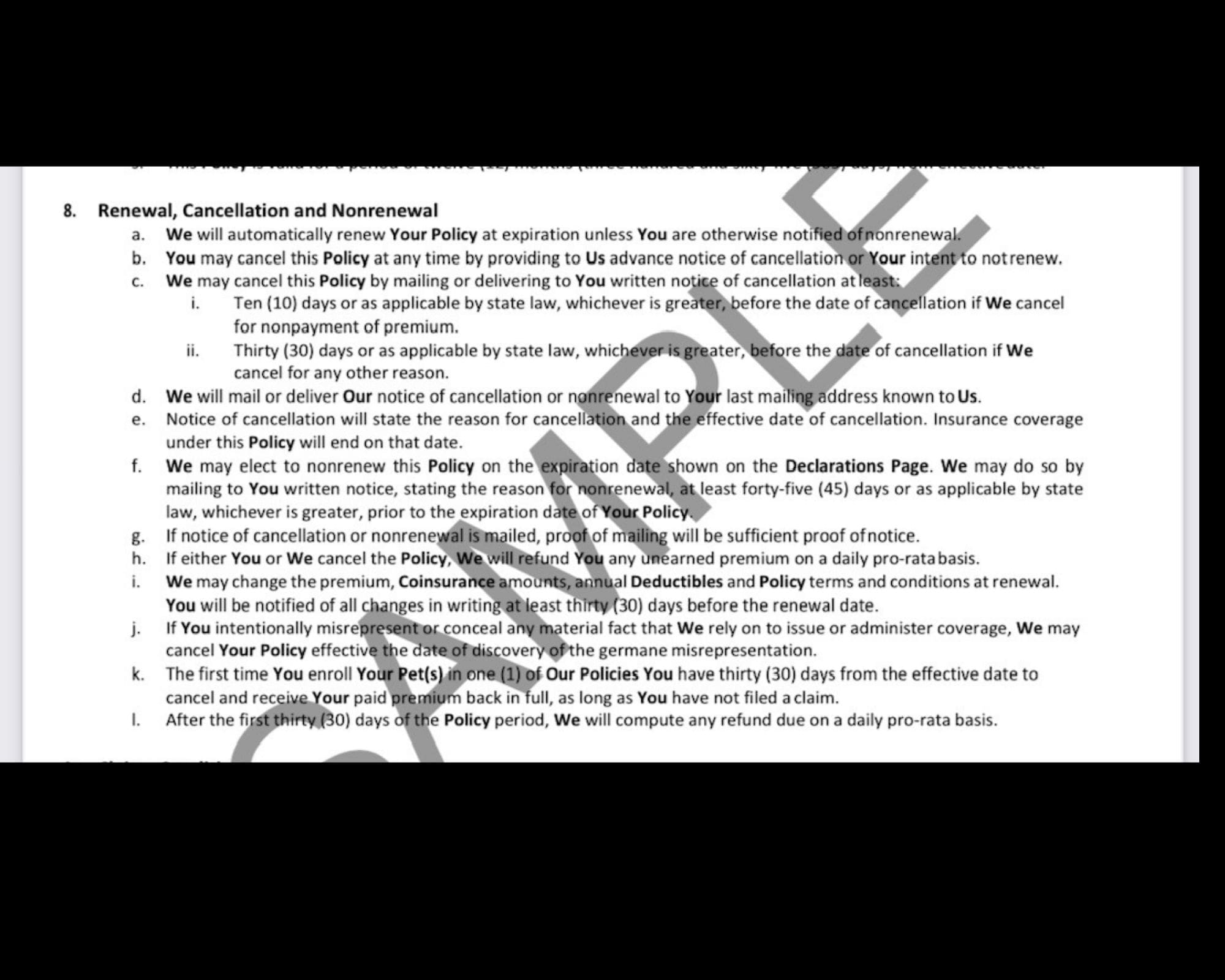

Let’s look at AKC Pet Insurance’s Cancel Clause fine print. Remember, the company’s leaders also declined to discuss specific questions about this language, including what was preventing the insurer from canceling a policy upon completion of the 365-day waiting period? Read these clauses carefully, because they’re not actually in every product, although they are common.

Renewal, Cancellation and Nonrenewal a. We will automatically renew Your Policy at expiration unless You are otherwise notified of nonrenewal.

In other words, “We are disclosing here that we will automatically bill you at each cycle, and autorenew your dog’s insurance–unless we decide not to do so! We need not provide a reason!”

b. You may cancel this Policy at any time by providing to Us advance notice of cancellation or Your intent to notrenew.

In other words, “Although we are not obligated to provide you with advance notice, you, however, are obligated to provide us with advance notice because this is what our fine print says!”

c. If We cancel the Policy within the first sixty (60) days We will specify the valid underwriting reason or reasons for cancellation in the written notice that will be mailed to the Policy address.

In other words, “Only if we cancel your insurance WITHIN the first 60 days are we obligated to provide a reason or reasons. Otherwise, we can cancel for any reason or reasons and need not provide them to you.”

If you read something and it strikes you as confusing, it’s probably not just you. This stuff is complicated by design. So, our suggestion is to do a bit of reporting work, not only because we want you to report back to us, but because we know it will have an impact. Go to your insurance company. Ask them to explain what’s stopping them from canceling your policy because your dog becomes more expensive to insure. If they answer by saying, “Every insurance company uses this language,” that’s incorrect because Trupanion does not do it (tell them) at least not in the U.S. and they say they’re addressing it now with their Canadian products. If they answer by saying, “We would never do that,” ask them why they need the language in the boilerplate if “never.”

Language like this doesn’t become less potentially harmful or less ripe for regulatory scrutiny because the majority of the market uses it. Ask your insurers and report back to us how they explain themselves. We’ll do the same.

Corrections

This article mistakenly referred to David T. Kettig as CEO of PetPartners, Inc. Mr. Kettig joined Iguana Capital, Inc., which acquired a controlling interest in PPI, as its Chief Executive Officer in 2021.

This article mistakenly referred to Lane Kent as COO of PetPartners, Inc. Lane B. Kent is the President of PetPartners and leads the Pet Division of Independence American Insurance Company.